Initially, the banking industry ignored the world of blockchain. Blockchain’s origins were in direct opposition to the banking system and the control that banking has over our lives.

As the blockchain industry gained momentum and investors earned their profits, the banking industry noticed. And when Ethereum and other crypto assets added smart contract functionality, the innovative vanguard of the industry saw massive potential.

It’s unwise to bet against the banks. Banks operate through their incentives to invest and adapt, and fight tooth-and-nail to keep their customers. While a minority of investors believe that blockchain could lead to a revolution displacing the power of large financial institutions, this is unlikely.

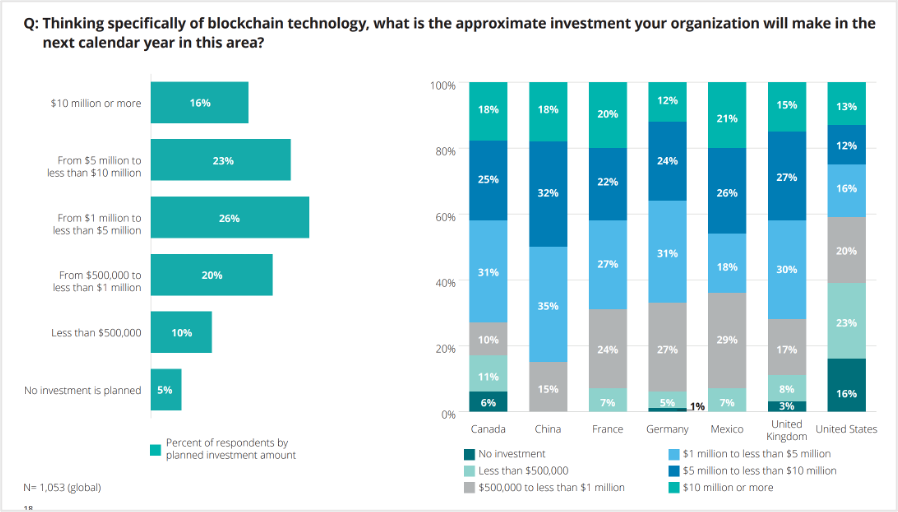

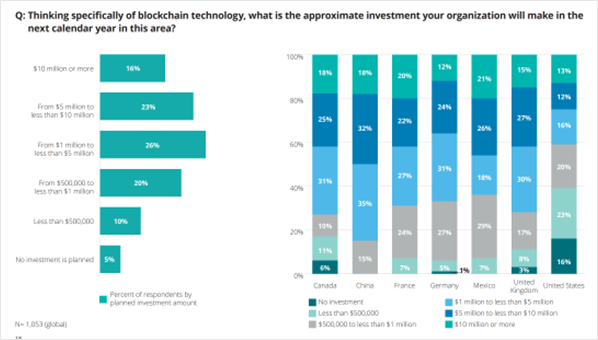

Prior to Covid in 2018, Deloitte conducted its Global Blockchain Survey and spoke with 1,000 banks. The survey demonstrated how much interest the financial world already had in blockchain technology. More than 95% of respondents confirmed they were investing or planned to invest in distributed ledger or blockchain technology.

Graph Courtesy of the 2018 Deloitte Global Blockchain Survey

As we move forward into mid-2022, and after wrestling with the pandemic, the initial curiosity seen in Deloitte’s study has manifested into realized projects.

A Need for Change

Many banking services are costly and slow, while other sectors are moving ahead quickly. They are replacing antiquated products and services with new versions.

Phones, cars, computers, and even lightbulbs are being reimagined–becoming more functional and efficient. Much of the too big to fail banking system is in no hurry to evolve, mainly due to fees.

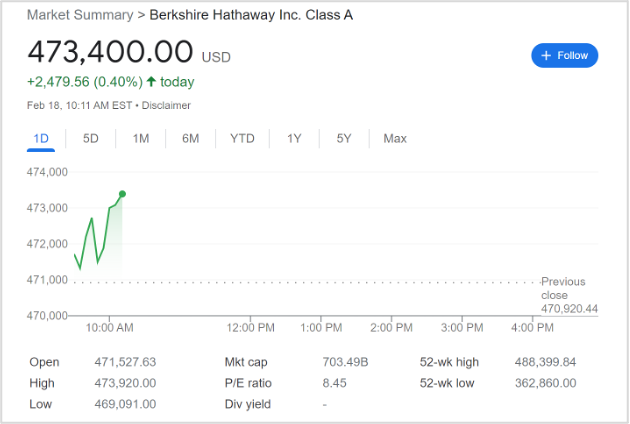

As they are for-profit organizations, they want to optimize returns. Banks earn spreads on their deposit interests paid versus the interests collected from loans. Depositors receive low-interest rates (fractions of a percent), but banks lend at higher rates:

- Today’s 30-year Lending Interest Rate = 4.921%*

- Student Lending Interest Rate = 4.5–7.3%*

- Average Credit Card Lending Interest Rate 19.53%*

Rates at this time of writing*

Banks easily found customers because there were limited choices. Debtors rarely complained, accepting their situations. With blockchain, debtors access lower rates from more competitive lenders.

Retail Banks Circumventing Competition

As blockchain evolved, more users learned that distributed ledger technology enables real-time transfers; no middlemen and no fixed costs.

Consumer finance players now realize that blockchain projects pose significant threats to their similar services. They understand that they will lose their customers if they fail to evolve.

How do banks fight back? They create blockchain-based solutions at prices low enough to prevent consumer switching.

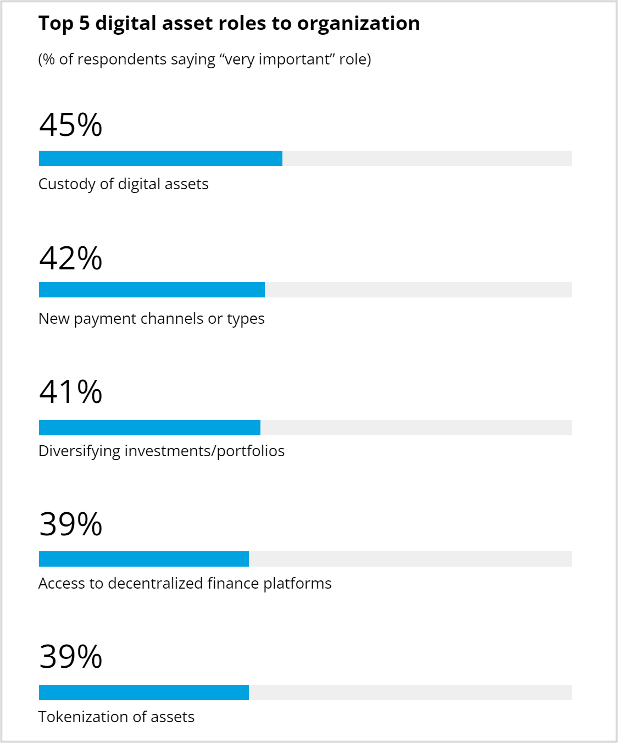

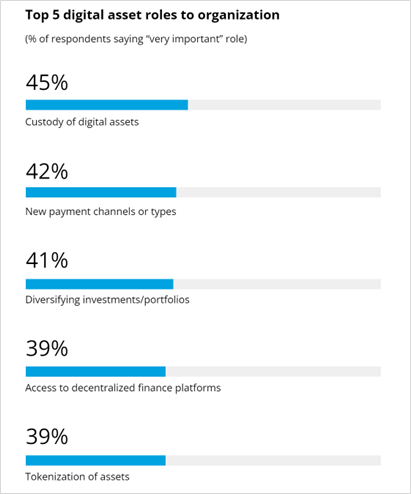

In Deloitte’s most recent Global Blockchain Survey, they found that many organizations were investing in projects across the board.

Data courtesy of 2021 Deloitte Global Blockchain Survey

Representing only a portion of the industry, financial institutions understand the need to connect with non-financial blockchain projects growing in parallel to them. Defining these necessary projects or solutions and integrating them effectively is crucial.

The Central Bank Movement Has Started

Globally, even slow-moving governments and central banks are beginning to create or overhaul their digital infrastructures.

The Biden administration made its first public announcement through an executive order recognizing the popularity of cryptos and their potential to destabilize traditional finance. This same order directed the federal government to create a crypto regulation plan, including the creation of a digital dollar.

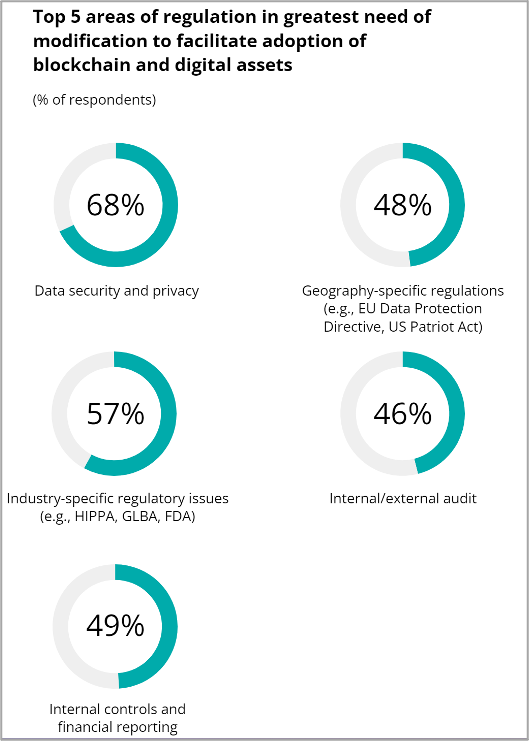

Data courtesy of 2021 Deloitte Global Blockchain Survey

Other nations’ central banks are adopting blockchain-based innovations and are overhauling their digital infrastructures to address complex operational challenges. Some central banks have already incorporated these technologies into their daily operations.

In 2019, the Bank of England undertook a proof-of-concept test determining how real-time gross settlement (RTGS) could evolve with blockchain. RTGS is a funds transfer system allowing for the instantaneous transfer of money and/or securities.

In 2017, they synchronized the movement of two different currencies across two different real-time gross settlement systems using Ripple. Great Britain has actively researched digitizing its economy’s governance and investigated a blockchain-linked pound sterling.

The BoE’s report says that a number of opportunities for achieving their financial and monetary stability objectives are possible with digital currency.

Returning Power to Central Banks

With national digital currencies, central banks can counter the dominance of Visa, Mastercard, and others over private networks by lowering transaction costs for users and small businesses. A “Digital Dollar,” “Britcoin,” or the “CDBC” (digital yuan) will each accelerate the creation and adoption of other national digital currencies.

Beyond Cost Savings

Banks look to blockchains for more than cost savings or improvements to their network efficiencies. They see blockchains as foundations to RTGS revolutions worldwide.

Through blockchain’s benefits, banks can increase the security of digital transactions and prevent errors, double counting, confusion, and fraud. Bookkeeping and auditing are examples of industries overdue for disruption by blockchain.

Distributed ledgers also address the world’s new realities. Global populations, particularly in Asia and Africa, were already reducing their use of cash before the worldwide pandemic. Still, reductions have quickened, and the use digital payments reached $5.4 trillion, growing by 16% year-over-year from 2020.

Much of the growth was seen in Europe and the United States, but they are far from catching up to China, which was almost $3 trillion (over half of all digital transactions) in 2020 and may become cashless soon.

The Digital Yuan

China is aggressively pushing the use of its “digital yuan” (the CDBC). It has gifted millions of the digital currency to its citizens in order to evaluate the feasibility of going cashless. While the initiative is not a true blockchain innovation as the CDBC is controlled by the central government and not decentralized, it demonstrates an increased use of digital infrastructure within the global financial system.

China’s mission is to ensure that any commercialization inherent to a blockchain-driven digital world matches its political makeup. Through the CDBC, China is playing a bit of a shell game: giving digital currency to users while maintain tight, centralized control. This is not the idea underpinning a decentralized, distributed ledger technology.

However, democracies want transaction transparency, and more of them are demanding that the costs of transactions be reduced. An open blockchain achieves both objectives as it has the five following traits:

- Open

- Permissionless

- Transparent

- Provides both finality and immutability of transactions

- Maximizes on-chain liquidity

These features create more intelligent, compelling solutions.

Continuing Evolution

More businesses will utilize blockchain as it continues to evolve. However, not all blockchain projects are the same. Successful winners must meet the demands of excessive data and transaction use.

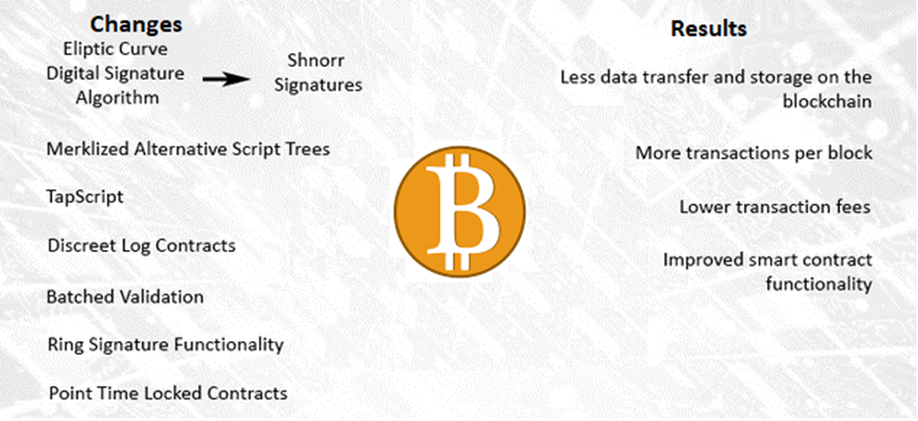

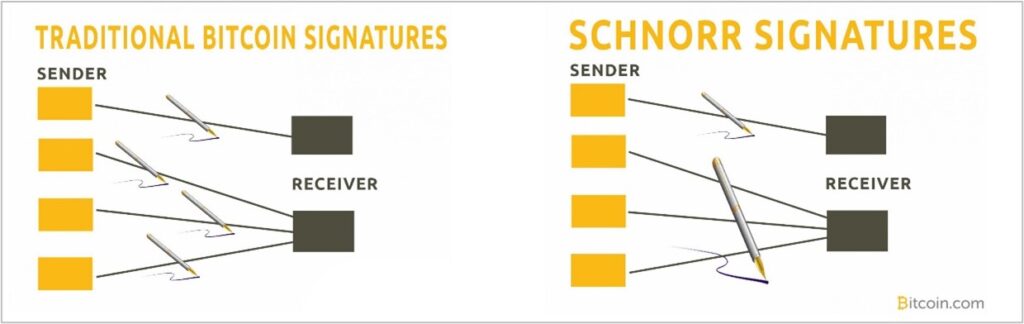

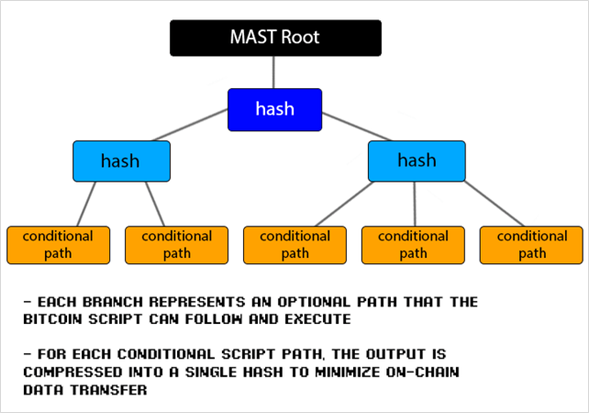

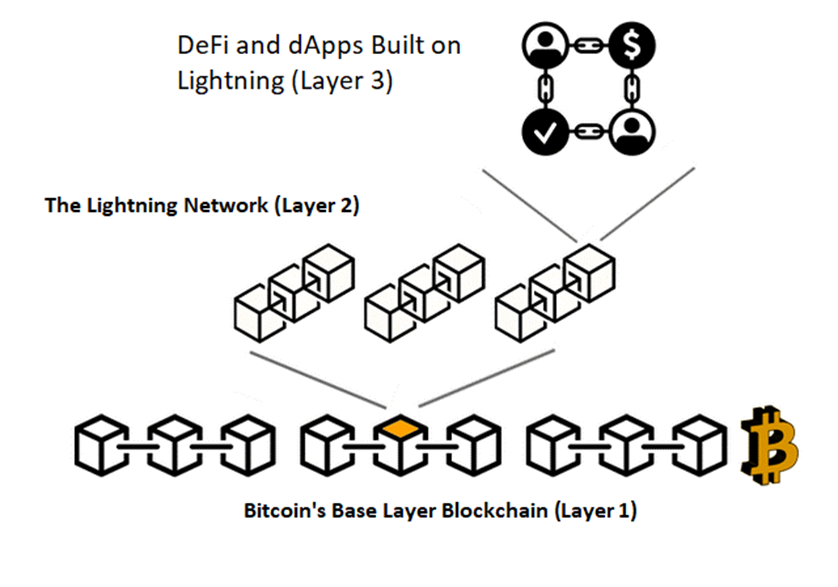

Bitcoin presents many solutions. It reduces cost, increases trust, bypasses third-parties, and prevents sources of inflation inherent to centralized, fiat currencies.

Tall orders, yes, but Bitcoin successfully delivers, albeit with some limits. It suffers from a seven transactions per second limitation. Layer-2 solutions (like its lightning network) add additional throughput and functionality. Other layer-1 solutions however, solve this too.

Any successful blockchain project must be cost-efficient, stable, and scalable (what layer-1 Bitcoin lacks). In October 2020, the Italian Banking Association introduced its “Sputna nodes network,” intending it to be cost-efficient, quick, stable, and scalable.

Sputna integrates most of the country’s banks, quickly processing transactions. This interbank cooperation creates a transparent landscape and standardizes Italian banking sector activities.

Moving Forward

The current state of blockchain and crypto feels akin to the mid-90’s internet boom. Blockchain is still not fully understood, and there will be a mix of successful (i.e., RTGS) and unsuccessful projects (i.e., Pets.com).

However, consumer banking must evolve to keep its customer base given the alternatives already presented by blockchain-based solutions. Central banks will have a similar task of creating digital systems balancing governmental desires with those of their citizens.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service, or offering. It is not a recommendation to trade.