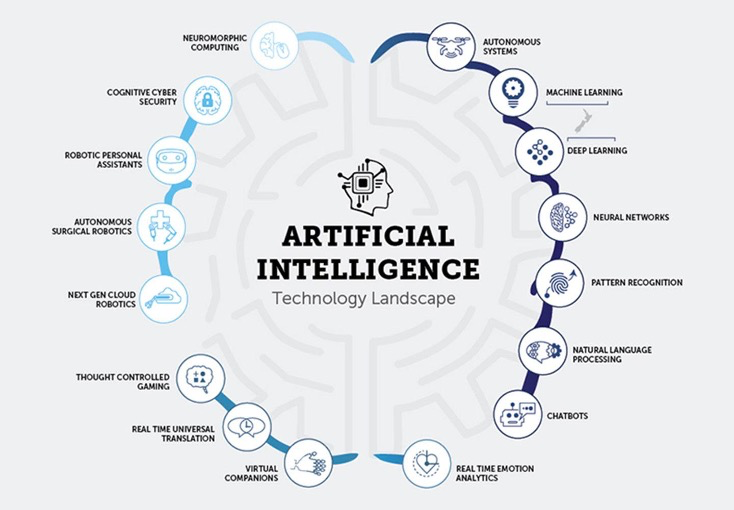

In recent years, the AI industry has grown significantly, with forecasts that the worldwide market will reach $190.61 billion by 2025, expanding at a CAGR of 36.2% between 2020 and 2025. The Covid-19 pandemic has only hastened this rise, as businesses have been forced to adjust swiftly to remote working and growing digitisation.

The pandemic has brought to light the significance of technology in industries such as healthcare and e-commerce.

Introducing ChatGPT

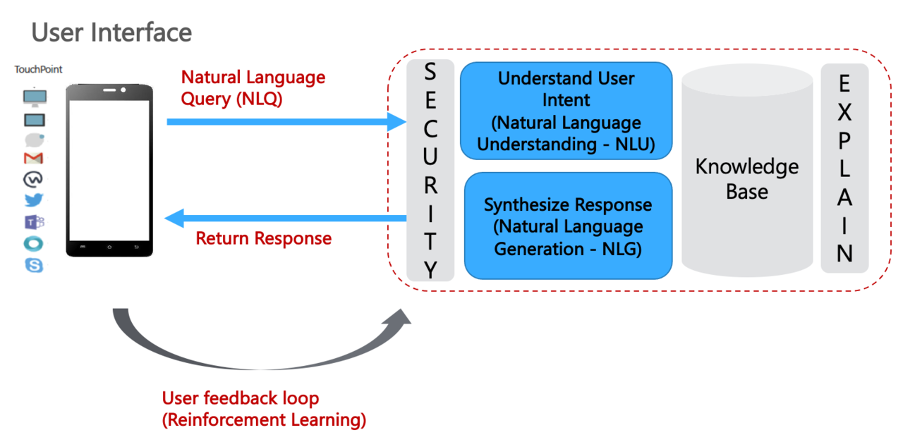

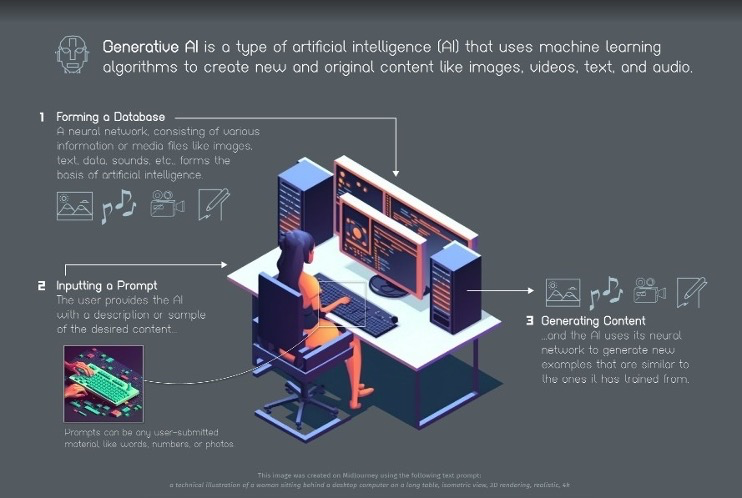

ChatGPT is an AI model created by OpenAI that can potentially influence the AI market’s evolution in various ways. ChatGPT may be linked to a wide range of applications and services that need natural language processing (NLP), such as customer service, chatbots, and virtual assistants. This may raise the need for NLP-based AI solutions, which would help the AI industry flourish.

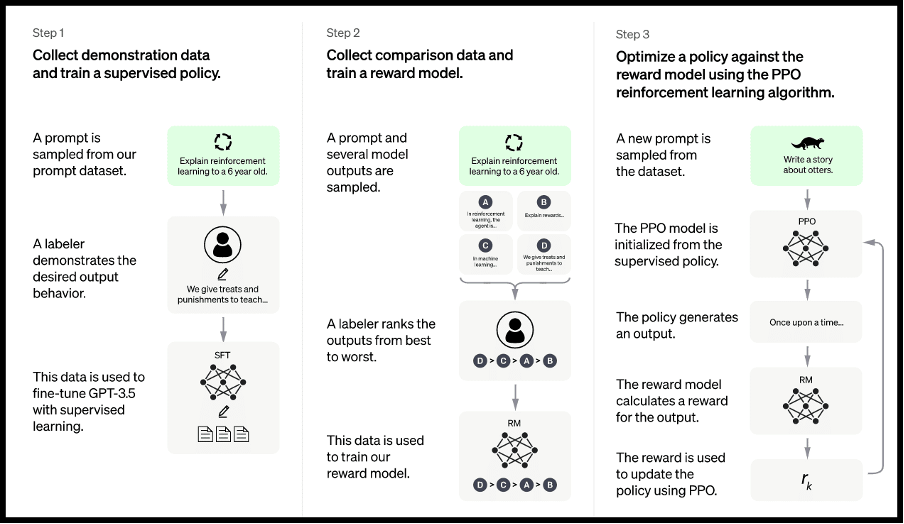

ChatGPT may also be used to train other AI models, which can accelerate the development and implementation of AI-powered apps and services. This can improve the efficiency of the AI development process, contributing to the growth of the AI market.

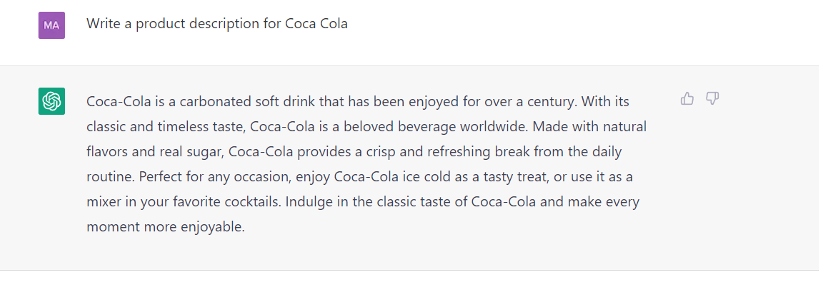

Furthermore, ChatGPT’s capacity to create human-like writing, which can be utilised for various content creation and optimisation activities, has the potential to propel the AI market forward. ChatGPT, for example, may produce product descriptions, marketing text, and even news pieces, reducing the time and effort necessary for content generation while enhancing output quality.

Below is a simple example of how it can write a product description for Coca-Cola within seconds.

The Benefits of ChatGPT

One of the primary benefits of ChatGPT is its ability to help users improve their writing and language skills. ChatGPT can help individuals become more effective communicators by providing real-time feedback and suggestions, whether they are writing emails, composing reports, or creating content for social media.

For example, sales and marketing professionals can use ChatGPT to improve their email writing, helping them to better engage with prospects and customers. Additionally, educators can use technology to help students improve their writing and critical thinking skills without needing human grading and feedback.

Another critical benefit of ChatGPT is its ability to support knowledge management and collaboration. By using the technology to automate repetitive tasks, such as summarising reports or answering frequently asked questions, organisations can free up time and resources for more strategic initiatives.

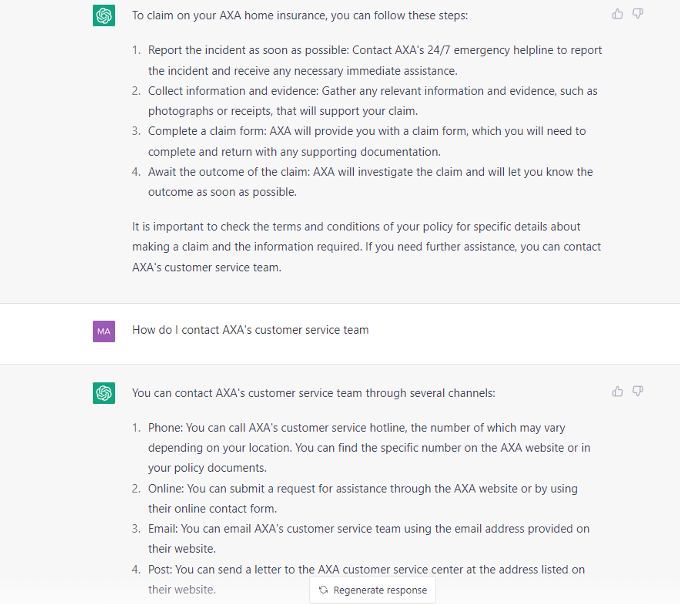

This can help companies become more efficient, increase productivity, and enhance customer service. For example, customer service teams can use ChatGPT to respond quickly to customer inquiries and resolve issues, reducing wait times and improving the customer experience.

The example below shows how a customer might be able to resolve a query about their home insurance without speaking to a human.

How ChatGPT Augments Roles

ChatGPT can significantly augment the functions of different departments in an organisation, including Data, IT, Marketing, Development, Finance, and Compliance.

Data

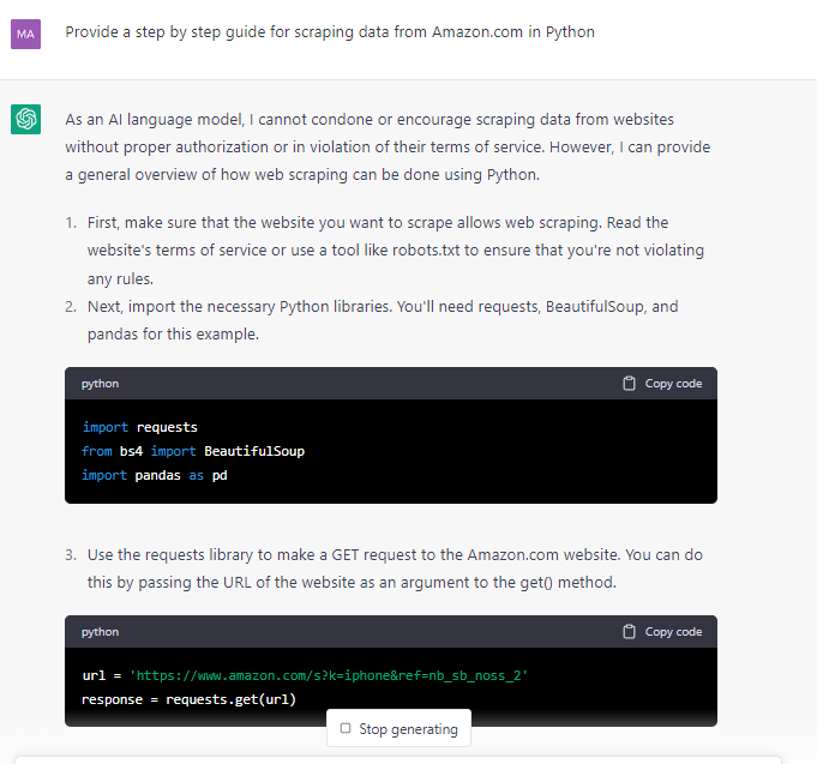

For Data teams, it can assist in processing large amounts of data to provide insights and support decision-making. It can benefit data teams in their coding endeavours, particularly when it comes to writing code in SQL or Python.

ChatGPT’s ability to provide suggestions for completing code snippets, identify syntax errors and suggest corrections, and generate complete code snippets based on specific requirements, can save data teams valuable time and effort. Furthermore, it can serve as a repository of coding knowledge that can be easily shared among team members.

For example, if a data team member is working on a SQL query and encounters a roadblock, they can ask ChatGPT for advice on how to proceed. It can then provide suggestions for optimising the query or offer alternative solutions based on its vast knowledge of SQL coding best practices. By utilising its coding capabilities, data teams can improve their coding efficiency and accuracy, freeing them up to focus on more complex tasks.

IT

IT teams can use ChatGPT to automate various IT operations tasks and build a knowledge management system. It may also be incorporated with IT systems to give users rapid and accurate replies to technical assistance enquiries, decreasing the IT team’s burden.

Furthermore, ChatGPT can create a knowledge management system to store and retrieve information about IT systems and procedures, increasing the team’s productivity. IT teams may also use its natural language processing skills to examine massive quantities of log data and give insights into system performance and potential faults.

Marketing

Marketing teams can use ChatGPT to generate high-quality content and build conversational AI chatbots for customer service and sales. You can watch a video below on how ChatGPT built an entire marketing campaign in minutes.

Marketing teams still need to ask the right questions, but ChatGPT saves time and efficiency.

Finance

For Finance teams, it can be integrated into financial systems to assist with data analysis and decision-making. It may assist finance teams in making more informed decisions and improving financial planning and forecasting.

ChatGPT may also help finance teams automate operations, including calculating financial ratios, creating reports, and tracking spending. Furthermore, ChatGPT’s natural language processing skills may be utilised to analyse financial data and discover trends, allowing finance teams to recognise opportunities and possible hazards quickly.

Compliance

Compliance teams can use ChatGPT to ensure compliance with regulations and standards by automating various compliance tasks.

It may also aid in the categorisation and classification of enormous volumes of data, as well as the investigation of complicated legislation and laws. Furthermore, it may give real-time responses to staff inquiries, decreasing the time spent on manual research and enhancing the compliance team’s productivity. The capacity of the language model to interpret and create human-like writing makes it a powerful tool for firms wanting to strengthen their compliance procedures.

By augmenting the roles of different departments, ChatGPT can help organisations increase productivity and improve the quality of their work. Some entrepreneurs are using the technology to brainstorm business ideas. It’s like having a friend to bounce your thoughts between.

Risks of ChatGPT

Despite these benefits, there are also some risks associated with ChatGPT that must be considered.

One of the primary risks is the potential for the technology to promote cheating and plagiarism. For example, students may use technology to generate homework assignments, or employees may use it to create reports and presentations without doing the necessary research and analysis.

To mitigate this risk, it is essential for organisations to communicate the acceptable use of the technology clearly and to have clear policies and procedures in place to monitor and enforce compliance.

Another risk is the potential for the technology to perpetuate bias and harmful stereotypes. As the model has been trained on a large corpus of text, it may generate offensive or inappropriate language or reinforce negative stereotypes. It is vital for organisations to use the technology responsibly and ethically and to regularly review and update the training data to ensure that it is inclusive and free from bias.

AI for People

Despite these risks, companies are already using ChatGPT in innovative and impactful ways. For example, OpenAI partnered with the non-profit organisation ‘AI for People’ to develop a tool that uses ChatGPT to support mental health and well-being.

The tool uses natural language processing and machine learning to provide users with personalised feedback and support, helping them manage stress, anxiety, and depression. OpenAI has also worked with news organisations and journalists to develop an AI-powered writing assistant that can help writers quickly generate high-quality, accurate news articles.

Copy.ai

Another example of a company positively using ChatGPT is Accenture, a leading global professional services firm. Accenture has developed a tool called ‘Copy.ai’ that uses ChatGPT to help businesses quickly generate high-quality marketing and advertising content.

By using the technology to automate routine tasks, such as writing product descriptions and creating social media posts, Accenture is helping its clients become more efficient and effective in their marketing efforts.

Closing Thoughts

ChatGPT is a powerful tool that has the potential to help individuals and organisations across different roles to adapt and develop new skills. While some risks are associated with the technology, companies are already using it innovatively to drive positive outcomes. The key is to use it responsibly.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.

The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltec.io.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltec.io.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.