Artificial intelligence (AI) has improved our terrestrial living standards for decades. However, can these practical computer algorithms be applied to applications beyond our planet, and if so, how can AI assist us in our space missions and interstellar exploration?

AI can help astronauts and ground-based space operations. AI is already becoming a vital component of space travel and its exploration, helping conduct tasks humans would otherwise be unable to perform while in space, such as the analysis of cosmic occurrences, system controls, the charting of stars, black holes, and more.

Many agencies and companies, like NASA, the European Space Agency (ESA), SpaceX, and Google, already use AI to find new celestial objects and improve astronauts’ lives in space. We will look at how AI is being used to aid in space exploration and what the future of Ai in space will bring.

Understanding AI

AI is a set of computer programs designed to match the thinking of humans. AI can be used to build ‘smart machines’ that perform various tasks that would otherwise require humans and their intelligence to run, in some cases much faster than a team of humans.

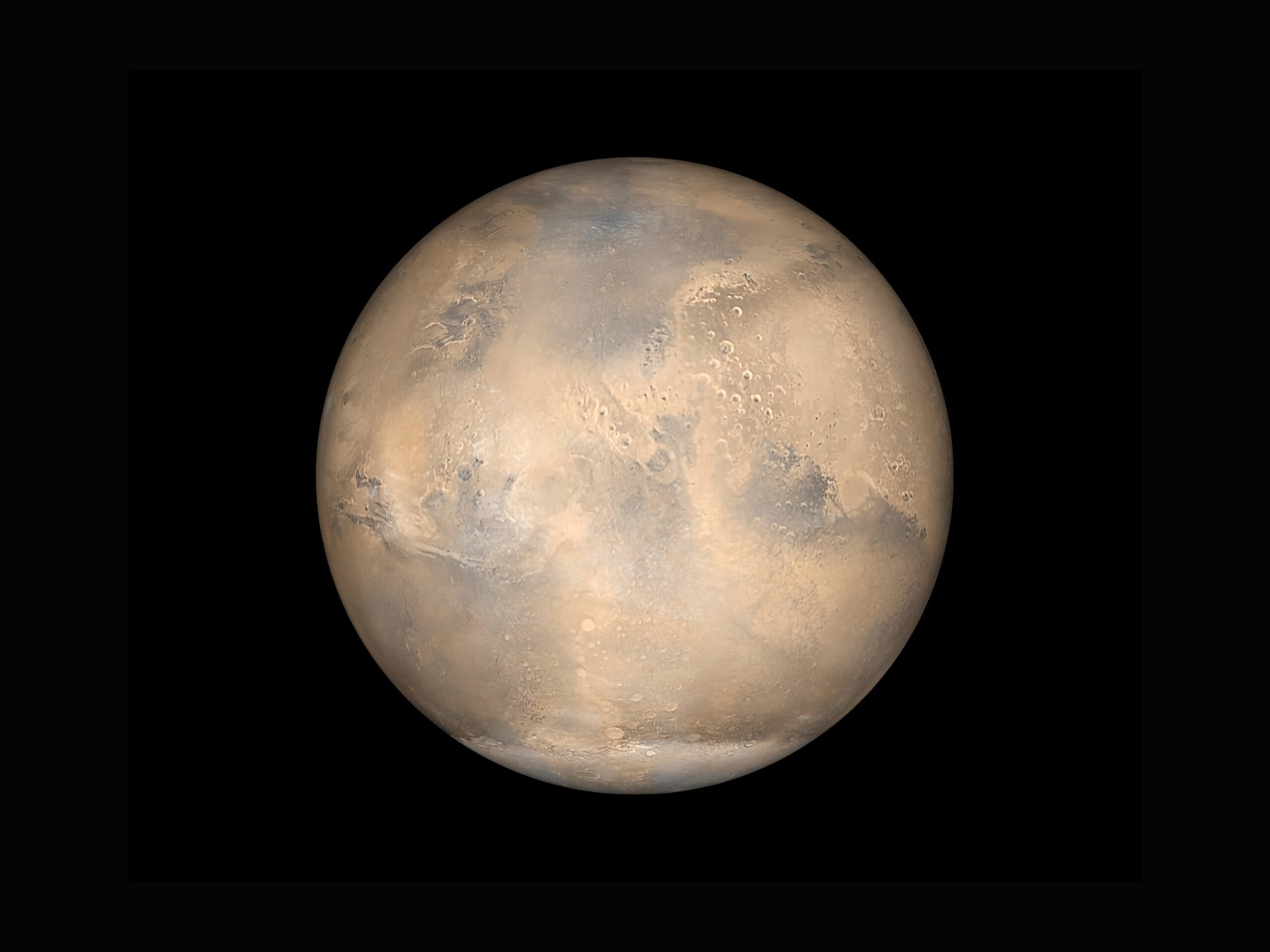

AI-Driven Rovers

NASA has already built autonomous rovers (such as the Perseverance rover) that use AI to complete their tasks and overall mission. These rovers can roam a planet’s surface, currently on Mars, and they are using AI to make decisions about the best routes to avoid obstacles and not require the earth-based mission control’s permission. Autonomous rovers are integral to some of the most important discoveries made on Mars.

Robots and Assistants

A larger field of AI is called natural language processing (NLP), which involves programming computers to understand speech and text. A subfield within NLP is called sentiment analysis, also called emotional AI or opinion mining.

Sentiment analysis is the foundation of intelligence-based assistants designed to support astronauts’ future missions to our Moon, Mars, and beyond. So while science fiction fans may be worried about 2001’s Hal-like problems, there will be failsafe mechanisms in place, and these assistants will significantly benefit the crew.

AI assistants will be used to understand and anticipate a crew’s needs, including their mental health and emotions, to take action in daily activities and emergencies. Moreover, robots will help astronauts with physical tasks such as docking or landing the spacecraft, repairs that would require a spacewalk and its elevated risk, and much more.

Intelligent Navigation Systems

We use GPS-based navigation systems like Google and Apple maps to define and explore our planet. However, we don’t have a similar tool that we can utilise for extraterrestrial objects and travel.

As a result, space scientists have had to get creative without GPS satellites orbiting around Mars and the Moon. In collaboration with Intel in 2018, NASA researchers developed their intelligent navigation system that allows for non-earth navigation, first on the Moon, and is intended to train it to explore other planets. The model was trained using millions of photos from several missions, allowing it to create a virtual moon map.

Processing Satellite Data

Satellites can produce massive amounts of data. For example, the Colorado-based space tech company, Maxar Technologies, has image data of 110 petabytes and adds about 80 terabytes to this daily.

AI algorithms process such data efficiently. Machine learning algorithms study millions of images in seconds, analysing any changes in real time. Automating this process using AI allows satellites to take images independently when their sensors detect specific signals.

In the UK, Leeds University researchers analysed the ESA’s Gaia satellite image data, applying machine learning techniques, and found over 2000 new protostars. Protostars are infant stars in the process of forming within dust and gas clouds.

AI also aids in remote satellite performance prediction, health monitoring, and informed decision-making.

Mission Operations and Design

AI can aid space missions by conducting autonomous operations. An Italian start-up, AIKO, developed its MiRAGE software, a library to enable autonomous space mission operations, as a part of the ESA’s tech transfer program.

MiRAGE allows a spacecraft to conduct autonomous replanning while detecting internal and external events and then take the appropriate action so that the ground-based decisions do not affect the overall mission objectives.

AI and machine learning can be utilised to evaluate operational risk analysis to determine safety-critical missions. Risk mitigation systems can also process vast amounts of data from normal operations and previous performance. After training a model to identify and classify risk, it can conduct a risk assessment and make recommendations or take action in real time.

Mission Strategy

During the Perseverance mission, the ‘Entry, Descent, and Landing’ or EDL flight dynamics team relied on an AI for both scheduling systems and mission planning to get through the ‘7 minutes of terror’ when the craft entered the Martian atmosphere until it touched down; the lag time for radio signals made it impossible to steer the craft manually from the earth.

Engineers and scientists see scheduling as an excellent task for AI to help with, as these systems need precise planning and would otherwise demand excessive human resources. Spacecraft can be programmed to determine how to execute commands autonomously according to specified functions based on past data and the current environment.

Location of Space Debris

The European Space Agency has stated that 34,000 objects larger than 4 inches threaten the existing space infrastructure. The US’ Space Surveillance Network is tracking 13,000 of these objects. Satellites deployed in the low Earth orbit can be designed to prevent becoming space debris by completely disintegrating in a controlled way.

Researchers are actively working to prevent the possibility of satellites colliding with space debris. Collisions can be avoided by designing collision avoidance manoeuvres or building machine-learning models to transmit the processes to in-orbit spacecraft, improving decision-making.

Likewise, pre-trained neural networks onboard a spacecraft can help guarantee the spaceflight’s safety, allowing for increased satellite design flexibility while minimising orbit collisions.

Data Collection

Like Maxar Technology’s image data, AI automation will aid in optimising the vast amount of data collected during scientific missions such as deep space probes, rovers, and Earth-observing craft. AI will then be used to evaluate and distribute this data to the end users.

Using spacecraft-installed AI, it will be possible to create datasets and maps. In addition, AI is excellent at finding and classifying regular features, such as common weather patterns, and differentiating them from atypical patterns, such as volcanic-caused smoke.

How can we determine what data needs to be provided to the end users to process? AI can minimise or eliminate unimportant data, allowing networks to work more efficiently, transmitting cascading important data, with essential data having a priority, and keeping the data stream running to capacity.

Discovery of Exoplanets

The Kepler Space Telescope was designed to identify and determine the frequency of Earth-sized planets that orbit sun-like stars, looking for Goldilocks zone planets. This process requires precise and automatic candidate assessment, accounting for the low signal-to-noise ratio of far-away stars.

Google and other scientists developed the AstroNet K2 convolutional neural network (CNN) to solve this issue. The K2 can establish whether or not Kepler’s signal is an actual exoplanet or a false positive. After training, the AI model was 98% accurate, and it found two new exoplanets, named the Kepler 80g and 90i, which circle the Kepler 80- and 90-star systems.

Closing Thoughts

AI has the potential to do many things that a human could not. They can also produce solutions to problems quickly and allow for decisions to be made autonomously that would require significant human power to complete. AIs are a way for us to continue to explore beyond our atmosphere and soon beyond our solar system.

A Solar Trip

AI will be helping NASA’s Parker Solar Probe, which will explore our Sun’s atmospheric corona. In December 2024, the probe will come within 4 million miles of the Sun’s surface. It will need to withstand temperatures up to 2500℉ and will help us learn how our Sun interacts with planets in our solar system, using its magnetometer and an imaging spectrometer. In addition, there is a goal to understand solar storms that can disrupt our current communication technologies.

Robonauts

We will likely see AI space assistants alongside astronauts or robots conducting deep space missions to new planets. Currently, NASA is working with SSL (formerly ‘Space Systems Loral’) to test how AI can be used to reach beyond our solar system.

Our decisions with AI allow for more risky missions and testing. These kinds of missions will enable us to make discoveries that will change human life and our future.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.

The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.