The advent of blockchain, cryptocurrency, and tokenization brings a new world of opportunities for issuing and managing investments.

The technology behind nearly all cryptos, blockchain, is an immutable distributed ledger. This fits perfectly with the changing financial landscape wanting single assets subdivided into smaller parts, enabling proportional ownership and enhanced liquidity.

Subdividing provides democratized investing and liquidity to historically illiquid assets, such as art, real estate, digital media, and collectibles. The secret behind the democratization: tokenization.

It calls for transparent and highly functioning markets. It holds the potential to change every asset class we know. So, what is tokenization?

Tokenization Explained

The tokenization of assets reflects to the process whereby an issuer creates digital tokens and places them on a blockchain or similar type of distributed ledger. These tokens represent either physical or digital assets.

The underlying blockchain confirms ownership of assets, matching them with their respective tokens. No authority can change or alter this ownership (its immutable) other than the owner with their private key. It’s explained best with an example.

Suppose you own a property in Chicago, Illinois, worth $1,000,000. Through asset tokenization, this asset is converted to 100,000 tokens, each representing 1/100,000th of the property. Let us next assume you have another opportunity and want to borrow $100,000.

You would rather not sell the property outright because you need a place to live, but you still need the funds. You decide to instead issue tokens on a public distributed ledger, the largest being Ethereum.

When someone buys a token, they are purchasing 0.00001 of your home. If they were to buy 100,000 tokens, they would be the owner of your home. Since your home’s tokens are on a distributed ledger, which is immutable, no one can erase a buyer’s ownership of your home’s tokens once the transfer is complete.

Tokenized Asset Types

If we are to focus on how tokenization works, and how tokens are constructed, we find that there are two specific types:

- Fungible

- Non-Fungible

Let’s go through the specifics of each.

Fungible (Asset) Tokens

Fungible assets have two primary characteristics.

Interchangeable. Each unit of a tokenized asset will have the same market value and validity. Our home example is fungible; Bitcoins are all exactly equal and fungible. They have the same market value and can be exchanged freely. Your 0.01 bitcoin (or fungible token) is worth the same as all other 0.01 bitcoin.

Divisible. A fungible crypto or other token can be subdivided into as many parts as was configured during token issuance. For Bitcoin, a satoshi is 1/1,000,000th of a bitcoin and is the smallest valid denomination available. It has the same value as any other satoshi.

Non-Fungible Tokens (NFTs)

NFTs represent the opposite to fungible tokens.

Unique. They cannot be replaced with tokens of the same type because each one holds a unique value with unique attributes. If you really did sell your house piece by piece, then the front entry tile would be an NFT.

Non-divisible. NFTs generally are not subdivided. However, there are F-NFTs providing fractional ownership of NFTs, and these are used for fine art investment or for commercial real estate.

Which Assets Are Tokenized?

With tokenization, the opportunities are endless because tokenization allows for both proof of ownership and fractional ownership. Traditional financial assets such as shares in venture capital funds, commodities, and real estate show only the beginning.

Exotic assets are now possible with fractional shares of racehorses, sports teams, artwork, and even a celebrity’s earnings. There are four main types of tokens.

Assets. These are items of value which the owner can divest into cash. Assets are further divided into two smaller classes:

Personal: personal assets, including cash and property

Business assets: those which appear on a company’s balance sheet.

Funds. Investment funds can be tokenized. These tokens represent shares of the underlying fund. Each investor would be provided tokens that, in total, are of equal value to their share in the fund.

Equities. A company’s (or other entity’s) equity shares can be tokenized. These assets are in the digital form of security tokens and are stored in an online wallet.

Services. To raise funds or conduct its business, a supplying firm can offer goods or services in token form. Investors can use the tokens to purchase the related goods or services the supplier provides.

The Benefits of Asset Tokenization

We will break these advantages into two perspectives:

Owner

Liquidity

The owner of a piece of art worth $500,000 needs $50,000 but does not want to sell the work to raise funds. The owner tokenizes the artwork into 500,000 security tokens, each valued at 0.0002% of the total. They sell 50,000 tokens without the selling the art itself, but ensures it is a liquid asset.

Fair Value

Assets that are not regularly sold have unestablished market prices. When this is the case, a seller needs to provide buyers with various incentives like an illiquidity discount, reducing the asset’s price. With the tokenization of assets, their liquidity is increased because it facilitates fractional ownership and eliminates illiquidity discounts.

Reduced Management Costs

When the ownership of a unique asset is transferred today, the process requires third-party intermediaries such as lawyers who will handle the paperwork and broker the deal. This trust-building takes extra time and may not be real if the intermediary is acting in the best interest of only one side of the transaction.

With the tokenization of the same asset the use of a decentralized blockchain and smart contracts automates several parts of the sale/transfer process, which saves that time and cost.

Investor

Liquidity Increased

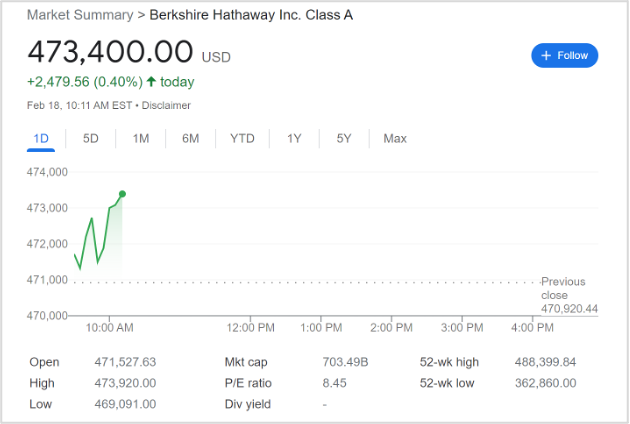

It’s now possible for retail investors to invest smaller amounts of money in a work of art, much like the fractional shares which have become popular on various online trading platforms. Retail investors can now buy fractional shares of Berkshire Hathaway stock, a transaction that would typically require an investment of over $470,000, but a fractional share is available for as little as $1.

Tokenization allows these same retail investors to diversify their portfolios into assets like fine art, benefiting from the increased liquidity. They could easily invest a sum of $5,000, which in the past was not possible without significant paperwork raising the cost and time needed for such a transaction.

Shortened Lock-Up Periods

Investors are restricted from selling assets during lock-up periods. The lock-up is usually implemented because the asset is large and illiquid.

The higher the liquidity of an asset, the more desirable it becomes. Tokenization potentially shortens or eliminates lock-up periods.

Transparency

Since the immutable nature of blockchain underlies asset tokenization, the history of an asset remains unchanged, preventing owners from making it look more attractive. Investors may the full history of an asset, allowing them to make more informed decisions.

Identity Security

With decentralized identity (DID) and ownership details maintained on a blockchain, the buyer’s public-private key pair is used as a digital signature to ensure their authenticity. This system can also be utilized for KYC/AML processes, and a standardized DID identifier ensures acceptance across different blockchain networks and platforms.

Tokenization and the Future

Tokenization is transforming finance.

The investor’s perspective may seem the same even as the investment options presented to them increase. Yet what happens behind the scenes remains revolutionary; that is, democratization through tokenization.

The primary obstacles standing in the way are regulatory and legal issues, given the variety of its applications. For example, digital trading cards have different hurdles to cross relative to works of art. The legal bridge between an asset and its blockchain requires the cooperation of knowledgeable legal and tax professionals who can solve cross-jurisdictional issues.

Bringing online other industries and its professional may take longer than expected, yet we expect new solutions to arrive as such fluency issues are resolved. We feel certain that tokenization will change investing for years to come.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.