As Bitcoin’s popularity continues to rise, so too does its global count of transactions.

All blockchain technology is at its core a shared database that is “distributed” among the nodes, allowing anyone to see all the transactions recorded on the chain. Transactions that are recorded on a blockchain network are unsurprisingly called “on-chain” transactions.

This builds trust and security. However, Bitcoin suffers from an issue of scalability. It has a limitation to how many transactions it can process in one second and in one block.

The Lightning Network is a potential solution to this problem. We will discuss the Lightning Network, how it solves the scalability issue, a few issues the lightning network itself must overcome.

What is the Lightning Network?

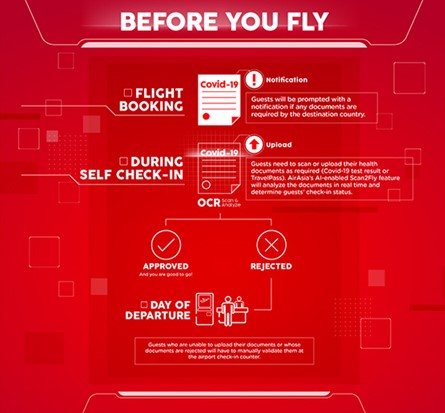

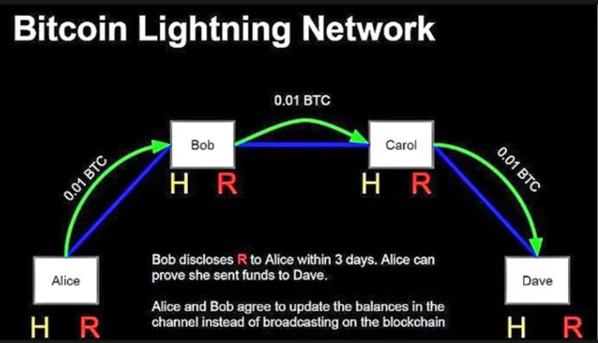

At its heart, the Lightning Network is a system allowing network participants to transfer their bitcoins between each other without any fees (or with minimal fees) by using their digital wallets. A payment channel is created between the two users (sender and receiver) so they can transact “off-chain” with each other. The Lightning Network is a layer on top of Bitcoin’s blockchain network to process smaller payments between participants.

This system means that on-chain transactions will be fewer, and the total processing time will be reduced.

Image courtesy of RAKESH SHARMA

With the Lightning Network, funds are transferred as quickly as the users’ wallets can communicate on the net. When business is concluded, there is a “closing transaction” on the main Bitcoin blockchain (layer 1) to settle all of the transactions.

The Bitcoin blockchain will not know how much each Lightning Network user owes until the bill is settled. Because transactions are generally not between trusted users when payment channels are opened, both sides place deposits of equal to higher values than the transactions themselves.

Is It Safe?

If, at any point, either user of a transaction wishes to back out, they can easily take their deposit and leave without consulting the other party. With such a one-sided withdrawal, the leaving side is required to wait for 1,000 block confirmations (approximately one week) to get their deposited bitcoins back. The party who did not leave will receive their security bitcoins instantly.

There are fraud measures built into Lightning. If one party tries to avoid paying the other, then the former suffers a penalty of forfeiting their whole deposit.

The Lightning Network also allows users to jump through connected payment channels. These “network channels” allow indirect connections of payment channels through intermediaries. This is how the creation of unnecessary payment channels is avoided as scale increases.

Ultimately, the lightning network works well for small transactions. Even if there are hypothetically over 1,000 transactions between users, the main blockchain shows only transactions: the first opening the payment channel and depositing money, and second closing it and settling the bill. All the transactions in between were feeless and instant.

Why is the Lightning Network Needed?

The general structure of Bitcoin’s network means that, when a transaction happens, it’s added to the newly created block once verified. The blockchain structure shows us that all its nodes each have a copy of the transactions for the vilification process.

In Bitcoin’s structure, these nodes are miners. Miners can only process a certain number of transactions per block, averaging 1,609, and there is only one block produced every 10 minutes. The network does lag down if the transaction volume becomes excessive. This leads us to Bitcoin’s scalability issue, where the network slow down significantly when it tries to process many transactions simultaneously.

This also leads us to increased transaction fees, chipping away at a central, founding tenet of Bitcoin. And users can occasionally offer to pay a higher fee to have their transactions processed sooner, similar to traditional wire transfers. Small transactions will suffer greatly from these fees.

The purpose of the Lightning Network is to cut away these transaction fees through scale and enhanced processing capacity. For Bitcoin to compete competing against the likes of Ethereum or Tether, it must improve its scalability.

Problems with Bitcoin’s Lightning Network

However, there are a few issues which the Lightning Network still does not solve.

There Are Still Fees

While Bitcoin’s congestion is one of several factors influencing its transaction fees, the cryptocurrency’s own fee is still a significant component of the Lightning Network’s overall costs.

There are also opening and closing fees which must be paid. The opening fee and its required deposit must be made on-chain. Once open, users process several transactions between each other or through network channels. But to settle a bill, the closing transaction is resolved on-chain as well. The deposited capital is tied up so long as the payment channel remains open.

There is also a separate routing fee occurring when there are payments between payment channels via other network channels. These fees are low, and the idea is to have them be low enough to attract more uses, but they are still required.

Let’s not forget the possible catch-22. If the fees via Lightning are too low, there may not be an incentive for nodes to facilitate these payments. As businesses adopt the Lightning Network, they may begin to charge fees for using it and negate its economic benefit. Some blockchains have already created solutions to this problem, allowing for cheap transactions through master nodes.

The Lightning Network is Susceptible

While there is cold storage available for use by funds on the Lightning Network, its nodes are required to be online all the time to send and receive payments. The involved parties must remain online and use private keys to sign in. The computer storing the private keys is vulnerable to hacking.

If a user is offline for an extended period, they are also susceptible. As stated above, the leaving side is required to wait for 1,000 block confirmations to receive their deposit. If one side closes the channel while the other is away for eight days or more, this is a fraudulent channel close, and nothing can be done to recover the lost deposit.

Network congestion due to a malicious attack also renders participants vulnerable to unreturned deposits. A forced expiration of many transactions could result and is a systemic risk recognized in the Lightning Network’s white paper.

A malicious party could overwhelm the capacity of a block by creating numerous channels that all expire at the same time. This situation would give the attacker the ability to steal funds from parties unable to withdraw them due to congestion.

An Unstable Bitcoin Price

While the Lightning Network is supposed to make small transactions possible, there is still ample room for growth and improvement. The current increase in on-chain transactions is from trading volume.

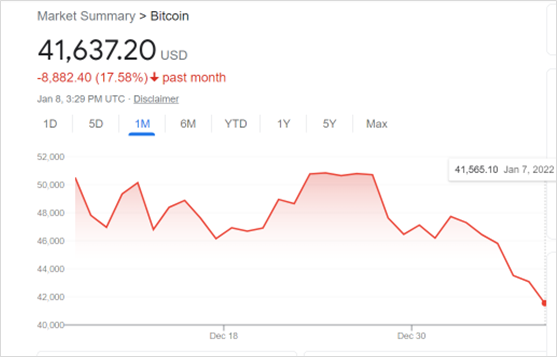

The added attention adds growth but volatility as well to the price. This volatility makes using Bitcoin as a payment tool difficult for merchants dealing with static inventory and planning accordingly with suppliers. When a company receives an invoice, it is often given 30 days or less to pay. If Bitcoin’s price drops 17.58% in 30 days, the supplier will be receiving an equivalent of 17.58% less fiat currency for their products.

Graph courtesy of Google Finance

This could create the need for an entire market of futures for nearly every product, or for a “frozen” market price detailed on an invoice. A similar risk exists for consumers who use bitcoins to purchase goods or service while receiving incomes in other currencies.

The Lightning Network’s Future

As of January 2022, the Lightning Network had a capacity of 3,300 BTC, up from 2,000 in August 2021. Arcane Research believes that up to 700 million users could be on the Lightning network by 2030.

The decentralized finance industry may help with this acceptance and use. Kraken stated at the end of 2020 that it would be making use of the Lightning Network in 2021:

“We expect to allow clients to withdraw and deposit Bitcoin on Lightning in the first half of 2021, which will allow clients to move their Bitcoin instantly and with the lowest fees.”

There may also be a solution for the automatic fraudulent channel close we discussed earlier in this article. “Watchtowers,” which are third parties running on Lightning Network nodes, could monitor off-chain transactions and prevent such transaction closes.

Summary

The Lightning Network represents a solid solution to a few of Bitcoin’s most significant issues. First and foremost, it encourages smaller transactions and widespread use.

If the security issues and malicious susceptibilities Lightning has can be solved, it will be a great addition to Bitcoin. More work is needed to improve Lightning. Yet it does give Bitcoin the opportunity of operating as a staple currency worldwide.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.