With the advent of blockchain, a new space has been created for the world of video games. GameFi has rapidly been expanding into the more traditional video gaming industry since its first appearance with Axie Infinity.

Axie attracts gamers to its universe by offering them opportunities to make money while they are enjoying the game. We will be explaining GameFi and the differences between it and the more familiar traditional video games we know, how one can get started on a particular GameFi game, and potential income streams they provide players and investors.

GameFi in Brief

GameFi starts with combining the words game and finance, similar to DeFi for decentralized finance. GameFi refers to a blockchain-based game model that has a play-to-earn feature that incentivizes players. In a GameFi ecosystem, blockchain technologies with cryptocurrencies and NFTs (non-fungible tokens) create a virtual gaming environment for the players.

Players can earn in-game rewards by completing in-game tasks, winning battles with other players, or reaching new game levels. These assets earned during play are owned and controlled by the player and can even be traded on crypto exchanges or NFT marketplaces.

GameFi’s Inner-Workings

GameFi player rewards come in many forms. Anything such as native cryptocurrencies or in-game assets like avatars, avatar features and costumes, weapons, virtual land, and virtual building materials.

Every GameFi project will create its own different game model and economy built around that model. Generally, a game will create its in-game assets as NFTs running on a blockchain project or sidechain, while in other cases, the in-game assets would need to be converted to NFTs before players could trade them. This second model can be a cost-saving method for the game’s project, putting the fees to create the NFT on the trader.

In-game assets will generally provide a specified benefit to the game’s players, which allows them to make additional rewards. However, some games will feature player avatars and cosmetic changes, which are purely visual and have no impact on either gameplay or the in-game earning.

Depending on the game’s model, players can earn rewards through the completion of tasks, winning battles against other players, or constructing and monetizing structures on their owned plots of land. Some games will allow their players to generate passive income, not even having to play the game. This can be through staking or lending of their owned game assets to other players.

Common GameFi Features

Let us look at GameFi’s most common features.

Play-to-Earn (P2E)

Nearly every GameFi project will have a Play-to-Earn or P2E model as a novel gaming mode at its core. This P2E model turned the gaming world on its head, which has relied on a Pay-to-Play (P2P) model that started with the video game arcades of the 1970s.

The Pay-to-Play model requires a gamer to invest before they can begin playing the game, putting money into the Astrids game at Dave and Busters, or nowadays purchasing a Call of Duty license or recurring membership subscription for their Xbox.

In the majority of cases, traditional video games with the Pay-to-Play model will not generate any financial rewards for their players, and any in-game assets that the player obtains are controlled and held by the gaming company only for use by that player. The P2E model, in contrast, will give players complete control over their in-game assets and will also provide them opportunities to make money for their play or passively.

The economics of the game will depend on the GameFi project’s chosen model. Games built around a decentralized blockchain technology can and should give their players complete control over their acquired in-game assets. However, this is not always the case. Players should understand how the chosen game works, its economics, and who is behind the project before devoting time to any P2E game.

One notable feature of P2E games is that they can be free to play but still have the ability to generate financial rewards for their players. However, some GameFi projects will require players to purchase NFTs or other crypto assets before being allowed to play.

Axie Infinity

Axie Infinity has gained the spot of one of the most popular Play-to-Earn games. Axie is an Ethereum-based game with NFTs that has grown in popularity since its release in 2018. Players can use their NFT pets, called Axies, to earn Smooth Love Potion (SLP) tokens.

These can be earned by completing daily tasks and by battling other players. Players can also get the rewards of another coin, the AXS, if they are able to achieve a defined player versus player (PvP) rank.

On top of this, Axie Infinity players can use both AXS and SLP to breed new Axies, and these new Axies can be used in-game or traded on the Axie Infinity NFT marketplace.

Beyond buying and selling Axies, players have the ability to lend their Axies to other players, in a process known as scholarship, allowing NFT owners the ability to earn without having to play the game. This model of lending gives the borrowers called scholars the use of the Axies to earn rewards during play without having to pay anything up front.

This passive model is a way for players with strong Axies to earn without investing other than what they made through their own play beforehand. Rewards earned with the borrowed Axie are split between the scholar’s student and the Axie’s owner.

Ownership of Digital Assets

Blockchain technology allows for digital asset ownership, and this makes it possible for owners to monetize their in-game assets in several ways possible for a project.

With traditional video games, a player can own pets, houses, avatars, weapons, tools, construction materials, and much more. But with GameFi, these assets can be issued in NFT form and minted on the blockchain. With this GameFi system, the player will have full control over their in-game assets. The ownership of these assets can be verified, are transferable, and can be authenticated.

With the rise of metaverse games such as Decentraland, TheSandbox, and a few other lesser-known games, the focus on virtual real estate has grown, and its ownership has grown as well. These games allow players to purchase and monetize their virtual real estate like it was property in the real world.

The Sandbox allows its players to buy plots of digital real estate and then develop these plots so that they can generate value through revenues. One popular form of development has been the creation of casinos in these metaverses. Some of the developed lands will charge other players to visit when they are the venue hosting content or events like virtual concerts bringing in thousands of visitors all paying to see the event, or they can also rent this customized land to other players who will monetize it.

Applications for DeFi

There are some GameFi projects that provide DeFi features like staking, liquidity, and yield farming. With these GameFi projects, a player can stake their game tokens to earn rewards, unlock special items, or gain access to new gaming levels.

The introduction of these DeFi elements can make blockchain gaming more decentralized. Traditional game companies will have centralized control of the game and its updates; some GameFi projects allow its community to participate in the game vision process, proposing future updates via DAOs (decentralized autonomous organizations).

Using MANA, the native governance tokens of Decentraland, players can vote on a project’s organizational and in-game policies if they lock their tokens in the DAO. The more tokens they lock, the stronger their voting power. This system allows gamers to have a direct influence on the development of the game they are playing.

Traditional Games and GameFi

With traditional games, a player can earn in-game currency that is used to purchase assets and upgrade characters. However, these tokens cannot generally be traded outside of the game space. They will also not have any value beyond the game’s scope, and even if they do, most games will prohibit players from monetizing and trading the earned/purchased assets in the real world.

Blockchain-based games have in-game tokens and assets in cryptocurrency or NFT form. Some games will use virtual tokens rather than crypto or NFTs. However, players can usually convert their in-game assets into NFTs if so desired, allowing the gamer to transfer their earnings to a crypto wallet and trade the crypto on exchanges and the NFTs on marketplaces. The crypto profits from in-game can be converted via an exchange or marketplace to fiat currency as well.

Joining the World of GameFi

There are already thousands of blockchain games available to play, and each has its own tokenomics system. Players should be careful of fraud projects or spoofed websites. Downloading a game from the wrong website or connecting a wallet to the wrong site can be detrimental.

It is best to create a new crypto wallet for the GameFi game and only use funds that can be lost in a worst-case scenario. Once you have found a Game you are confident with, you can begin.

Create a Crypto Wallet

Accessing a game will require a compatible crypto wallet. MetaMask and Trust Wallets are commonly used.

The chosen game may use a different wallet or connect to a specific blockchain network. Blockchain games on the BNB Smart Chain (previously the Binance Smart Chain) will require that a Metamask wallet be first connected to the BSC network. A Trust Wallet or other supported wallet could potentially be used.

Games running on the Ethereum network can be accessed when you connect your wallet to the Ethereum blockchain. Some games like Gods Unchained and Axie Infinity have built their own wallets, reducing costs and improving performance, so you may need to create one of these.

Connect the Wallet to the Game

A wallet will need to be connected before gameplay can occur. Connect with the official website only. Find the website and look for the wallet connection option. Most blockchain games will use your wallet as your account username and password, so most games will ask you to sign a user message to your wallet, allowing you to connect to the game.

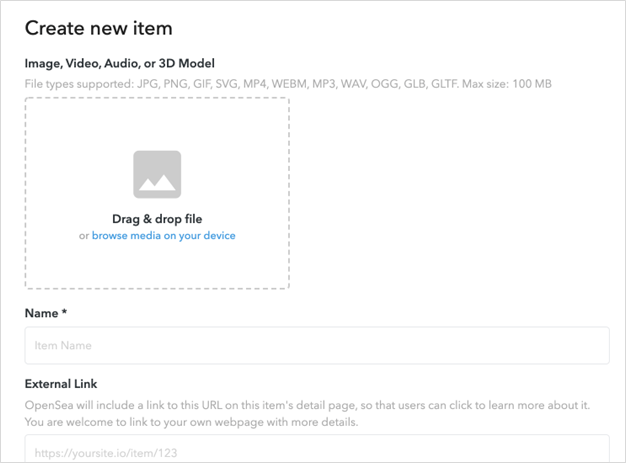

Check Game Requirements

Most projects will require the purchase of some native cryptocurrency or an in-game NFT to begin. The upfront requirement will vary from project to project, and you should consider this purchase’s earning potential and overall risk before moving forward. Include in this estimate the time needed to get your initial investment back, and any profits that can be obtained.

3 Axies are needed in a wallet to play Axie Infinity, which can be purchased in the marketplace. This purchase will require wrapped ETH (WETH) in a Ronin Wallet. ETH can be bought elsewhere, and the Ronin bridge can be used to transfer the ETH to your Ronin Wallet. If you do not have the upfront funds, you can look for a scholarship program. Allowing you to borrow NFT Axies, but you will share your earnings with the Axies’ owners.

GameFi’s Future

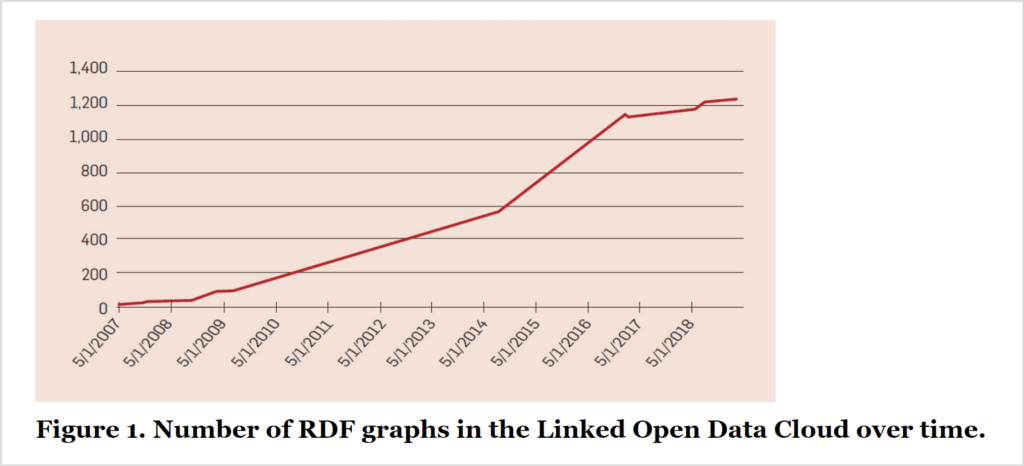

In the past year, GameFi has grown tremendously and will likely continue with the spread of more blockchain projects. In July 2022, DappRadar lists nearly 1750 blockchain games, up from about 1400 in March of the same year–25% in four months.

There are now popular games crossing multiple blockchains beyond Ethereum and the BNB Smart Chain, including Solana, Polygon, Harmoney, and more. The ability for players to own and earn from their in-game assets is especially attractive in developing countries. With the continued growth of blockchain tech, the GameFi world will continue its speedy growth.

Final Thoughts

Browser games have hoped to make Bitcoin profits since the beginnings of blockchain tech. Ethereum was created from a desire of a young man to have control over his in-game assets. The advent of smart contracts has changed the potential of the gaming world, with decentralized novel experiences and opportunities.

GameFi can attract gamers, providing an entertaining escape and a financial incentive. The growing popularity of blockchain-based games will continue and will likely be a driving force behind the development of the metaverse.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.