Cryptocurrency carries this cryptic veil around it. Its coins allure investors new and veteran, far and wide, hoping to strike digital gold by gambling with its infamous volatility. Stablecoins, however, suffer from a keen lack of volatility.

Likely you know about Bitcoin, Ether, and the sporadic rollercoaster affecting their prices. Less likely you know about the intrinsic details and uses of fiat-backed stablecoins, and why regulators of the traditional banking world appear to like them.

This article walks you through stablecoins, from their basic mechanics to their incredible uses as digital coins pegged to respective fiat currencies.

What Are Stablecoins?

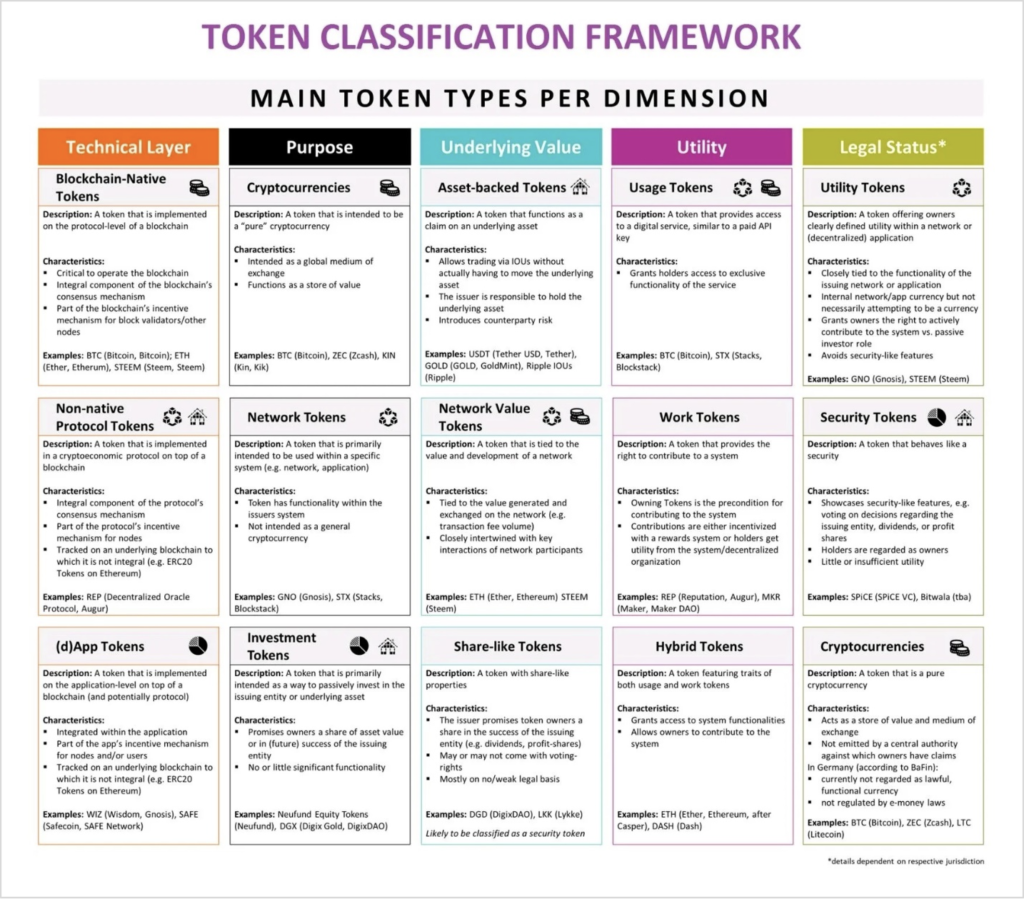

Stablecoin is an umbrella term referring to any cryptocurrency (crypto) whose value is pegged to the value of an external asset, often a fiat currency.

Popular crypto, such as Bitcoin, provide the essential benefit of removing all intermediaries in your daily use of cash. This opens up “banking” to any one person living on the globe. Yet a key weakness is the volatility inherent to most crypto coins as our world adjusts to this new asset class.

Enter stablecoins, whose aim is to remain, well, stable. How a stablecoin achieves this depends on the coin.

We have four common types: fiat-backed, commodity-backed, crypto-backed, and algorithmic. Each type maintains a reserve of an external asset “backing up” the stablecoin’s value. Algorithmic refers to an unbacked or partially-backed coin primarily using algorithms to manipulate supply and demand to maintain the often 1:1 peg against the external asset.

Understanding Fiat-Backed Stablecoins

The base mechanic of a fiat-backed stablecoin feels almost too simple. When a user wishes to exchange their tokens, they simply return them as they receive the fiat equivalent from the coin’s reserve. The exact dollar-to-coin count is maintained, and the peg, unaffected.

Yet fiat-backed stablecoins possess certain nuances which must be addressed.

First, any fiat-backed stablecoin derives its value from the value of its reserves. Whether these are in euros or in US dollars, both the regulators and investors must feel confident in the coin’s ability to maintain its (likely) 1:1 peg.

Second, fiat-backed stablecoins must remain free of theft- or hacking-related events, in addition to providing regular reserve audits. A recognized accounting firm needs to audit their reserves. Further, the coin operator itself would benefit from a complete audit.

For example, popular USD-pegged stablecoin Tether, with a current market capitalization of 66 billion USD, intends to undergo a full audit of its reserves. Amazingly, this transparent and forthright attitude seems to have caught regulators off guard, with Tether’s CTO Paolo Ardoino calling for immediate regulation.

Third, its transaction fees must stay minimal, with 24/7/365 capability. This feels obvious to many, but remains after all a prominent reason as to why Satoshi Nakamoto truly unleashed the cryptocurrency phenomenon in 2009.

Uses of Fiat-Backed Stablecoins

There are four common uses for incorporating stablecoins into your portfolio.

Saving

Volatility makes fortunes, but it also kills. Every investor’s goal is to use it intelligently and avoid destroying their savings.

When not investing in traditional equities, funds, or cryptocurrencies, stablecoins represent an ideal safe haven void of intermediaries and high fees. Utilizing a secure, offline, “cold” digital wallet helps here if you would like to keep the bulk of your savings in a digital, Swiss-like vault.

Transfering

Wire transfers continue to earn notoriety for their high transfer costs, often approaching 100 USD equivalent depending upon the bank, the country, and the destination. Further, the concept of waiting two or more days for receiving money already belonging to you, such as any receivable, seems inconceivable thanks to the advent of cryptocurrency.

Stablecoins and their creators remain aware that stablecoins represent the “cash” portion of any digital portfolio. Thus transferability continues to be a priority alongside liquidity. For both Tether and USD Coin stablecoins are going to have zero transaction costs in the near future–in addition to instant transferability.

Staking

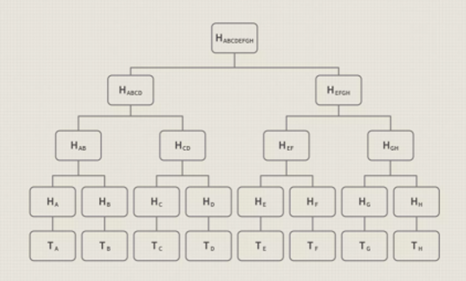

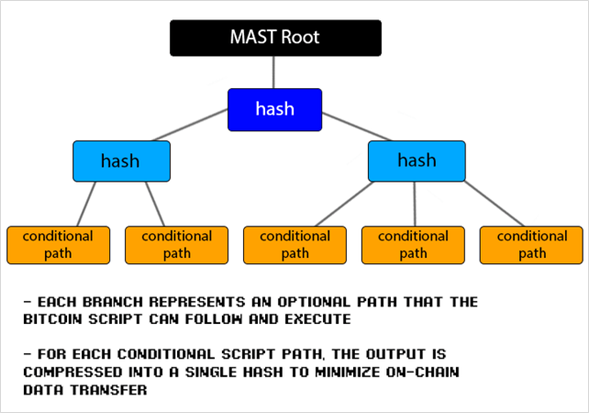

Unique to cryptocurrencies, “staking” refers to the process of locking your stablecoins into a “deposit” onto the blockchain. Effectively, you’re leasing your stablecoins over to the host blockchain in order for said blockchain to operate.

This is how Proof-of-Stake competes against Bitcoin’s Proof-of-Work. With the former, those users, or “validators,” who have staked their coins with the blockchain earn rewards as the chain uses their coins to validate new transactions onto the block. Users are chosen at random, though with larger deposits favored over smaller ones.

Proof-of-Work operates as it sounds. Many “miners” compete to solve the hash puzzle necessary for adding the next block of transaction data to the blockchain. The work itself, replicated by many competing miners across the globe, proves the transaction’s authenticity.

Staking applies to stablecoins as certain blockchains prefer stablecoins, such as Tether or USD Coin, over more volatile counterparts (i.e., Bitcoin, Ether, Algorand). Alternatively, the recipient blockchain may use the staked stablecoin as a guarantee for another coin or more volatile asset.

Source: Whiteboard Crypto

Establishing Liquidity

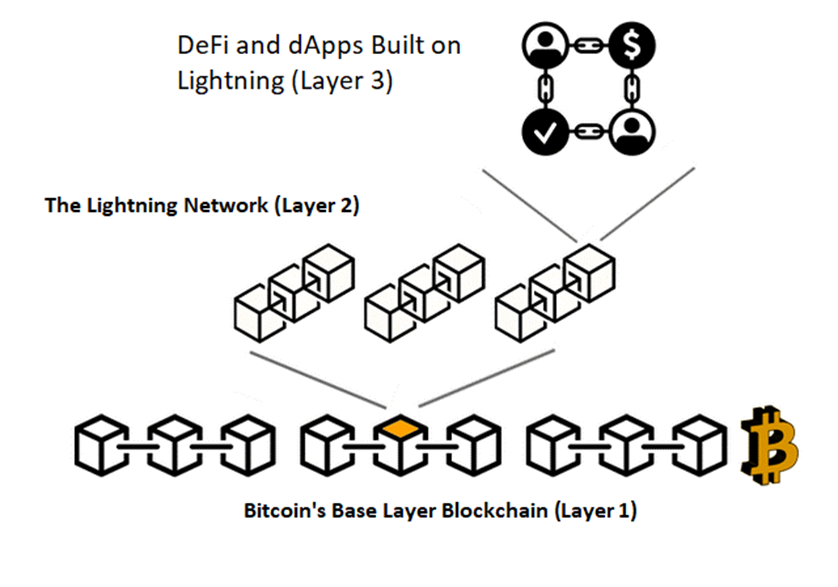

A rapidly rising vanguard of stablecoins, liquidity pools represent a new area in which holders earn attractive yields well above traditional interest rates.

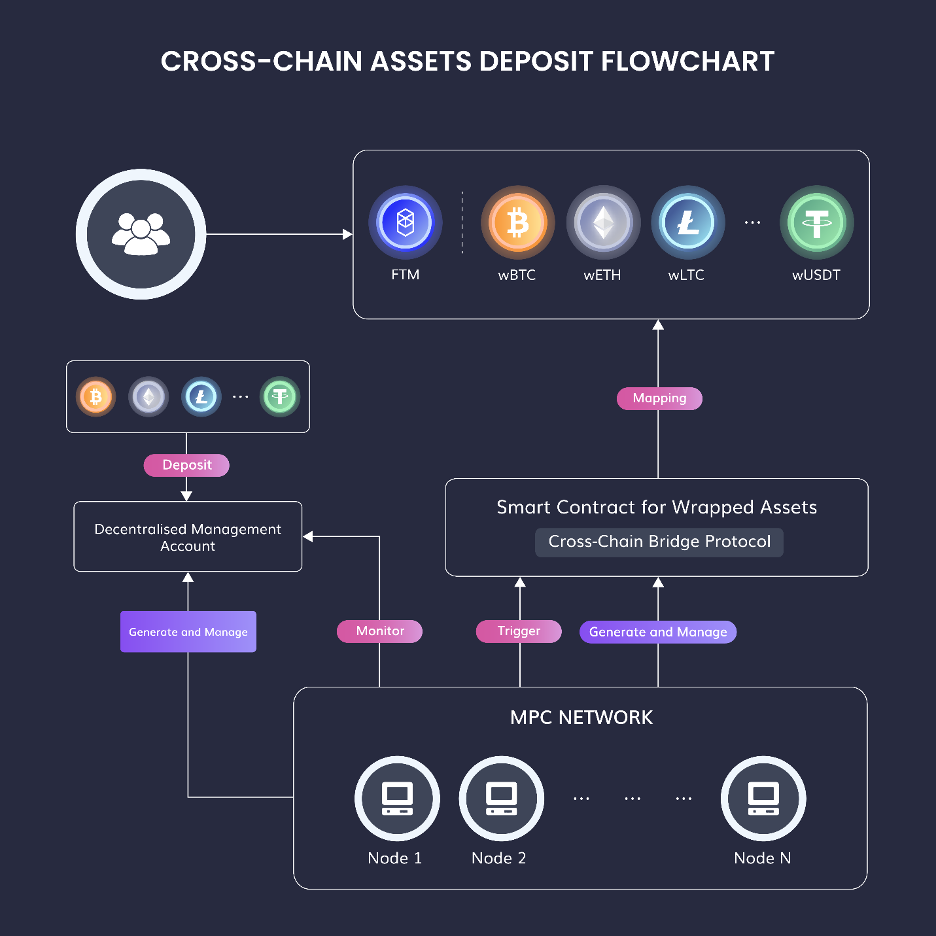

Bundles of stablecoins are pooled together from many different lenders, similar to staking, and facilitate various Decentralized Finance (DeFI) activities operating under software protocols called “smart contracts.” Think of these pools as smart programs using the digital currency lent to them in useful or novel ways.

For example, a liquidity pool could support the Ether-Tether currency trading pair. In exchange for lending your Tether coins to this pool, you might earn a yield up to 18% by taking a cut from the overall transfer fee revenue.

However, stablecoin holders take on the key risk of losing their principal (Tether) value. The asset pair in that pool must maintain a total constant value. Since Tether shall always equal one US dollar, you sacrifice value stability in exchange for a possibly incredible yield. In other words, if the value of the Ethereum coin falls, your Tether is sold off in a bid to increase Ether demand inside your specific liquidity pool.

The Bottom Line

Stablecoins tackle the two key issues affecting fiat currencies: fees and intermediaries. They offer zero or limited fees and the complete removal of all institutional intermediaries.

The core strength of blockchain technology is its public immutability. The global community contributes to the operation and honesty of blockchains, and thereby, stablecoins. They are community-managed, always-active mediums of exchange.

Yet the vast majority of global trade continues to use one fiat currency or another. One glaring reason for this: a lack of regulator guidance. For the time being, this also means a bind to fiat, but one without centralization, volatility, fees, delays, and wire transfer horror stories.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Conor Scott, CFA, has been active in the wealth management industry since 2012, continuously researching the latest developments affecting portfolio management and cryptocurrency. Mr. Scott is a Freelance Writer for Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service, or offering. It is not a recommendation to trade.