If you wish to either evaluate a token or develop one of your own, you should understand the differences between the types of tokens. New users join the blockchain world daily, including politicians, regulators, and other decision-makers who can significantly influence the future of this technology.

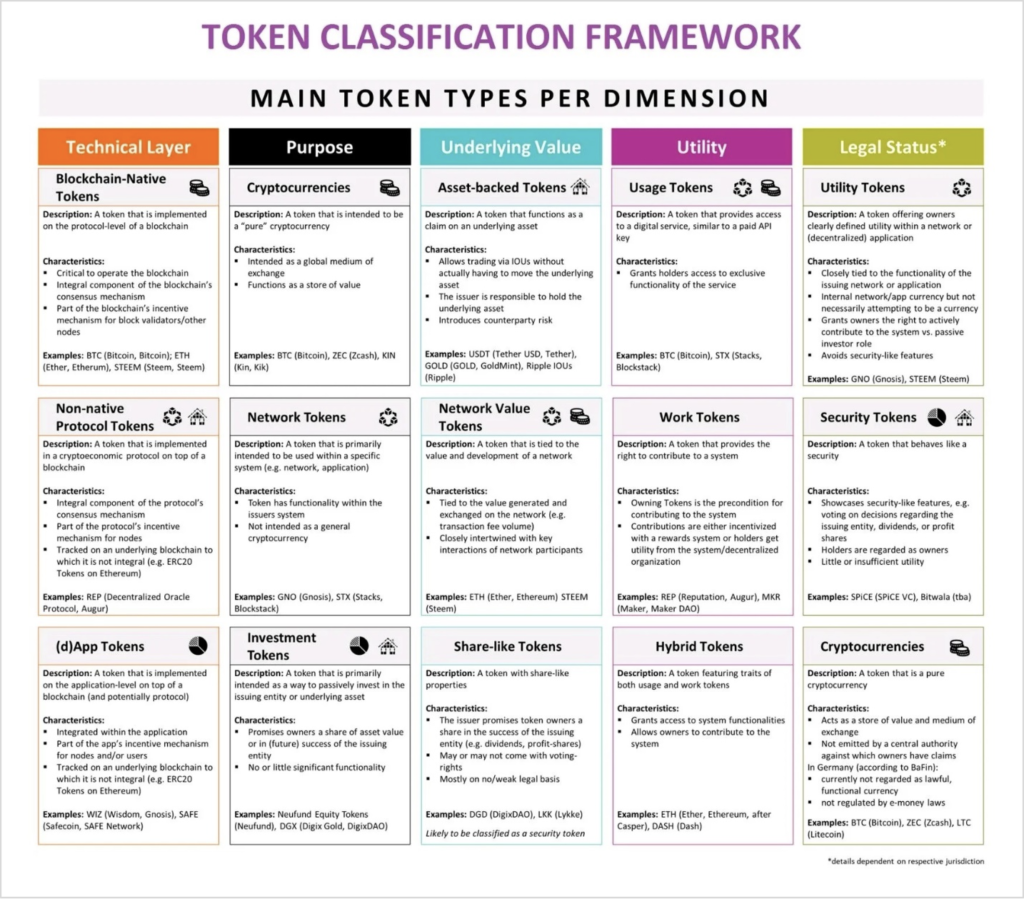

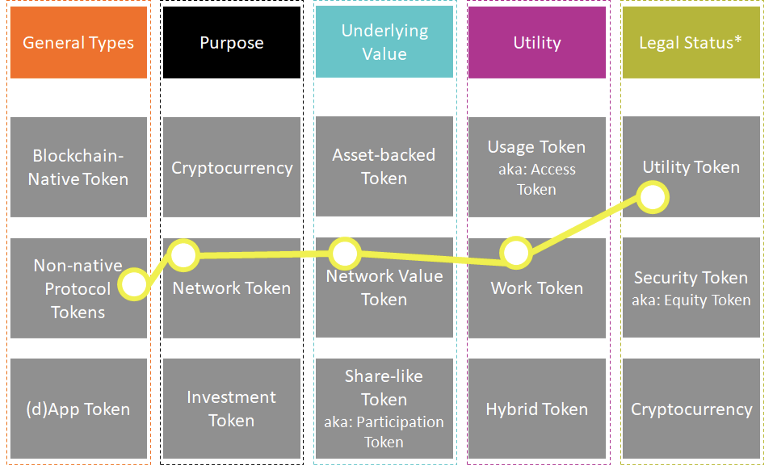

They will need clear and relevant knowledge of blockchain’s innerworkings so to make informed decisions. The best tool we have found for evaluating and separating tokens into different categories was created by Untitled INC.

Image courtesy of Untitled INC

This framework has multiple uses. It incorporates all the current token types and enables readers to draw distinct lines between them.

Its development is ongoing but free for all. It was released for free use under a Creative Commons BY-NC-SA license allowing anyone to share, copy, redistribute it in any format, and to remix, transform, and build upon the material.

It’s a living document. As the field expands, extra dimensions may be added to the framework.

Five Dimensions

Tokens can be divided into five dimensions.

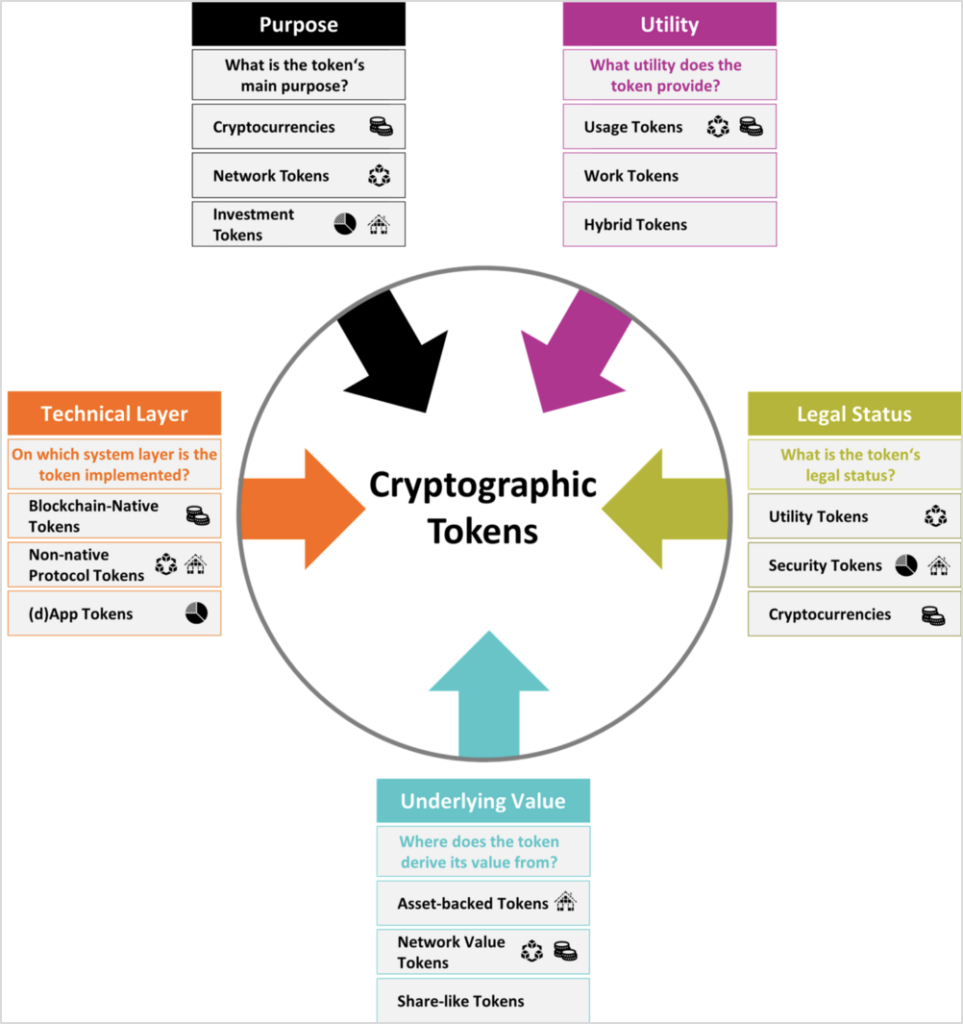

Image courtesy of Untitled INC

These five dimensions are:

- Purpose. What is the token designed to do? Misunderstanding the token’s purpose leads to incorrectly calling it a cryptocurrency. It can be used as a cryptocurrency, or it can aid a network’s growth (network token) or simply act as an avenue of investment (investment token).

- Utility. There are four general categories:

- Usage – provides network access or features

- Work – provides work to the host system or blockchain

- Hybrid – offers both a and b

- Useless – no utility

- Legal status. As more regulation occurs, this category will evolve, and the presiding jurisdiction may alter a token’s classification. If a token provides no network nor service features, or is not a pure cryptocurrency, then it’s usually classified by regulators as a security token. But some tokens will hover between the two. Current legal frameworks were developed before tokens, and they may have to be adapted.

- Underlying value. Most tokens are created with underlying monetary values, but the sources of these values differ significantly. They can be IOUs for real assets or rather like stocks with commercial or equity links, values which fluctuate. We do find that the network’s value may determine the token’s value, making valuation more interesting relative to traditional investing. However, value is extremely difficult to determine.

- Technical layer. Implementation of tokens occurs on different layers of a blockchain-based network. Generally, there are three technical layers:

- Blockchain-native tokens – the chain’s native token

- Non-native protocol tokens – part of a crypto-economic protocol that sits on the blockchain

- DApp tokens – a token on the application level

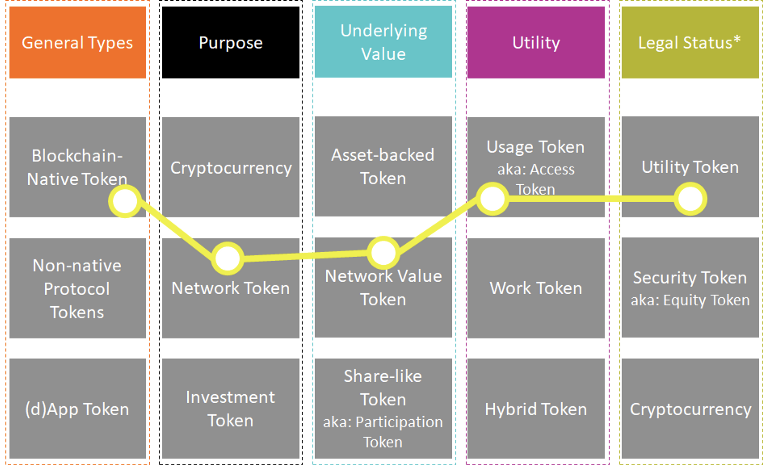

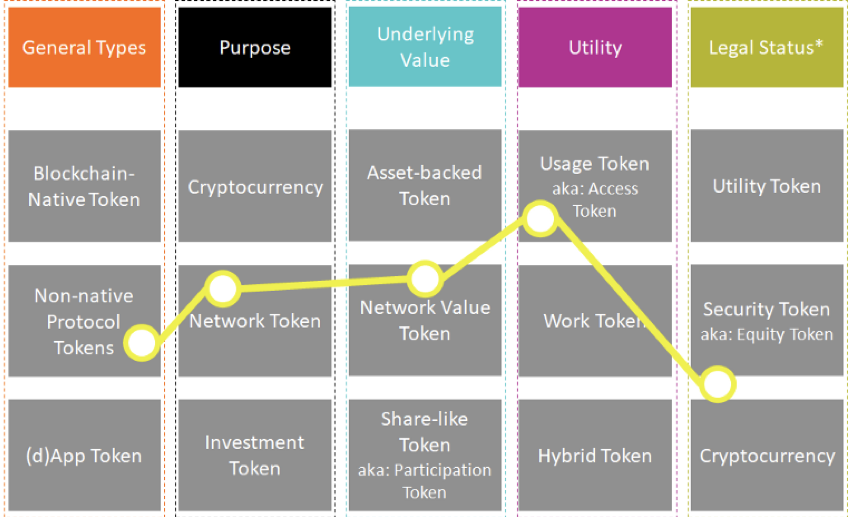

These five dimensions are complementary, and tokens are not exclusive to only one. Most are assessed through all dimensions. We will see that when we look at the archetypes of tokens, there are strong correlations between them.

Token Archetypes

Generally, there are four token archetypes:

Cryptocurrencies.These have a use as a store of value (SOV) for wealth, are not controlled by a central authority, and can either be mined or pre-mined. There is no counterparty risk.

Tokenized assets. These provide access to assets such as gold, but also enable microtransactions. The issuing authority has control of the underlying asset, leading to counterparty risk since ownership is tied to one entity.

Tokenized platform. A platform-like network that is not owned or operated by a central entity. Users start with limited roles, but now roles are available to all network participants. The token’s value, either financially or in terms of utility, moves with the network.

Shared tokens. This is a tokenized financial instrument for investing in a company, with characteristics of a stock. The tokens improve on the traditional share model by being flexible, and having smart contract programmability. As regulatory frameworks develop, this is the most targeted and vulnerable of the token types.

Tokens As Part of a System for Valuation

Crypto tokens are only one component of a blockchain or distributed network. They are integral but should be evaluated in conjunction with the other two layers of a network: governance and technology.

Evaluating Matrices

It helps to look at some examples to see how the use of a framework aids in valuing any token.

Steem is an incentivized blockchain social media platform that uses three currencies: STEEM, Steam Power, and Steem$. STEEM is used as the currency of the publishing platform, measuring reputations and providing rewards to creators.

STEEM is its own blockchain. Therefore, it’s the native token. It’s used for keeping the network running and is therefore also a network token. Since its use is providing network features, it’s also a usage token, and because it provides a service (network), the legal status is deemed as a utility token.

Kin is both a token and an app inside an app ecosystem. Kin is used to pay for digital services inside several apps available on its network. In Germany, the Kin token could be regarded as a security and regulated as such.

Kin is not just a cryptocurrency but has functionality and programmability contributing to the user experience. It’s a non-native token, and similar to STEEM, a network token doubling as a cryptocurrency as well.

It’s also a network token and a usage token, but it differs from STEEM in that it can act as a cryptocurrency outside its system. Therefore, it can be regarded as a security token.

The classification of tokens feels confusing to many, since they are relatively new and without a well-defined classification system. A good rule of thumb is this: any “crypto” can also be one or more types of “tokens.”

Augur is a no-limit betting platform enabling gamblers to bet on sports, economics, world events, and more. Augur tokens are used to incentivize “Oracles” on the network who are essential to its function (Oracles bring off-chain data to the chain) as a decentralized prediction market. Oracles report events and receive a share of all network fees for their work.

Since it was built on the Ethereum network, Augur is a non-native protocol token. Its primary use is to provide a reward for a needed function and is therefore a network token. And since the token is awarded as a result of work for the system, it’s a work token. An Augur token is not used outside the system, however, and so must be exchanged for external use. Thus, it’s also a utility token.

Summary

The Token Classification Framework is a great system for defining cryptocurrencies or tokens. It requires users to think critically about their uses and identify their potential forms of regulation.

As public sectors across the world dive into tokens, they should invest the time to define them according to their uses and subtypes rather than as part of the larger “crypto” buzzword. Yes, the presiding understanding of token classification remains limited, but the space is growing alongside the potential of blockchain.

The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service, or offering. It is not a recommendation to trade.