We’ve previously covered the basics of stablecoins and why fiat-backed stablecoins are winning over regulators. Yet that begs the question: what should stablecoin regulation look like?

The foremost goal of a stablecoin remains to provide stability. Like with any traditional security, the regulator keeps a strict adherence to the primary intention of that asset. An equity comes with full and fair disclosure of the underlying company (SEC), while derivative trading should occur under optimal market conditions (NFA).

Yet the USA, home to the most active stock exchange in the world (NYSE), maintains no such regulator for stablecoins or for any tokens at all. Similarly, the EU and Japan fail to demonstrate any form of current, effective stablecoin regulation.

Meanwhile, the market capitalization of Tether grew from less than 1 million USD to over 66 billion USD in less than six years. Tether currently sits as the third largest cryptocurrency in the world, following Bitcoin and Ethereum.

This article dives into the inevitability of stablecoins, their impending regulation, and what exactly that regulation should look like. Let’s get to it.

Why Do We Need Stablecoin Regulation?

Following the S&P 500 and Nasdaq bear markets of 2022, cryptocurrencies–a vanguard asset class–took a turn for the worst as investor sentiment plummeted. Inflation skyrocketed to new highs of a generation, recently surpassing 10% in Spain or 8.5% for the USA, as major stock indices fell by 20% or more from their last highs.

Stablecoins, like the bonds of last century, seek to preserve value and purchasing power (i.e, USD) during times of stress like these.

Fiat-backed stablecoins, such as Tether and USD Coin, succeeded in doing just that. By keeping an equivalent amount of US dollars to back, 1:1, the amount of tokens in circulation, they maintained the respective values of their stablecoins–1 USD.

Algorithmic stablecoins, however, have a history of failing. Their intention was both noble and innovative as they strove to remain independent of fiat currencies, their inflations, and their high transfer fees. However, an arbitrary algorithm relying upon normally operating markets and standard arbitrage (“buy low, sell high”) cannot maintain its mandate of stability.

Most recently, we saw TerraUSD’s value crash from 1 USD to a few cents. Unfortunately, this is nothing new in the world of algorithmic coins. Yet it did shave off 40% from the total value of cryptocurrencies dedicated to “decentralized finance” protocols (programs). Maintaining an arbitrage is simply one example of a protocol.

Regulators worldwide then caught on that they need to catch up with private entrepreneurship, for market participants are getting involved with or without them.

Stablecoin Regulation, Coming Right Up

Three major economies have agreed to or are planning imminent stablecoin regulation: the EU, the USA, and Japan.

In June 2022, the EU Council agreed to a general regulatory framework for “crypto-assets” and their service providers. This lengthy agreement both acknowledges the ever-growing importance of all cryptos and provides five essential upgrades to its markets:

- Consumers shall receive protection in the event service providers lose their assets or their digital wallets

- Relevant actors shall declare their environmental footprints

- Stablecoin holders shall be entitled to claims at any time and free of charge by issuers (withdrawing cash for fee, 24/7/365)

- Stablecoin service providers shall maintain ample fiat reserves at all times

- Crypto-asset service providers will need an authorization to operate within the EU

In April 2022, Sen. Patrick Toomey of Pennsylvania introduced the Stablecoin TRUST Act to the US Senate. While defining fiat-backed stablecoins as “payment stablecoins,” it largely echoes the spirit of the EU’s framework. Further, it maintains that a bank-centric or traditional regulatory approach is not best suited. Instead, it implies a holistic approach.

Also in June 2022, Japan’s parliament passed a bill defining stablecoins as digital currencies, mandating links with the yen and demanding the consumer right of always redeeming stablecoins at face value.

But, What Should It Look Like?

Regulators generally have rejected algorithmic stablecoins and anything not linked to fiat. While they very likely cannot reject Bitcoin nor Ethereum in the future, they are clearly tabling that for post-stablecoin.

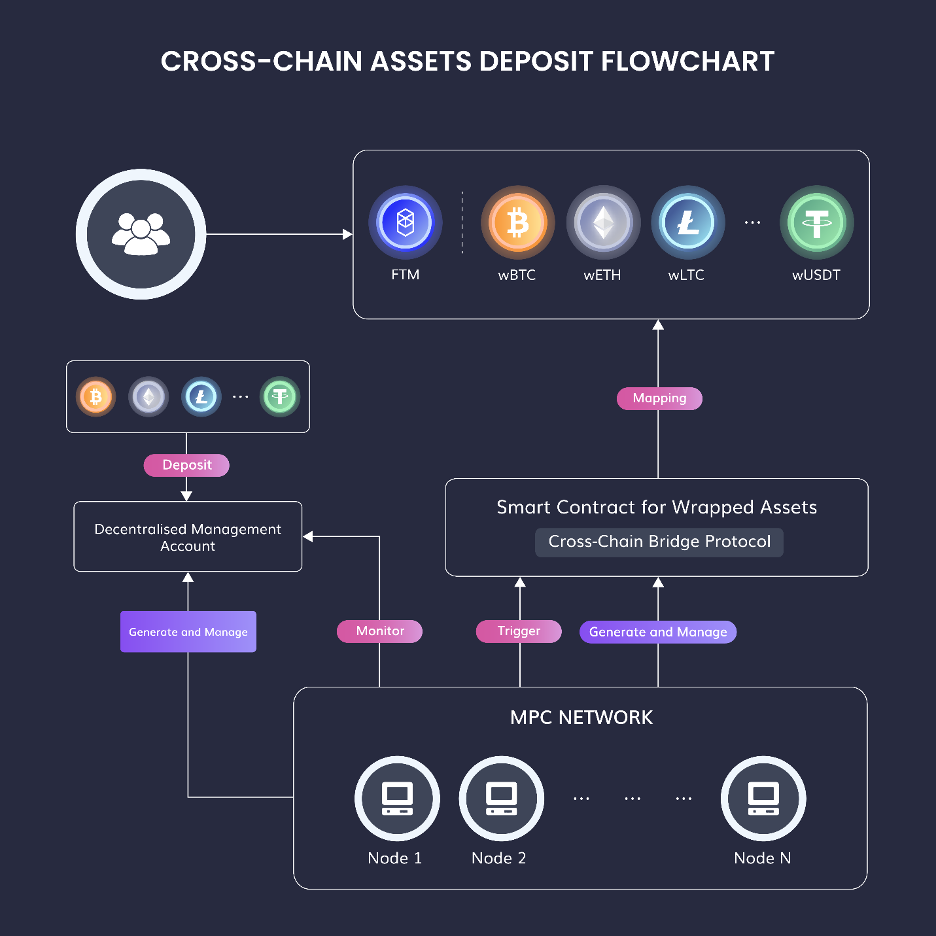

In other words, fiat-backed stablecoins make easy targets since, while they’re promoting instant and feeless transfers via blockchain technology, they’re not eliminating the use of fiat.

As the EU does have an unofficial reputation for covering even the most stringent details in the hopes that their regulation is followed elsewhere, we closely examined their regulatory framework–dubbed “MiCA,” or Markets in Crypto-Assets. We found five points, and that any final piece of legislation should:

- Not limit transactions. If a theoretically unlimited amount of US dollars can be exchanged for euros within the eurozone, then a USD-backed, 1:1 should receive the same treatment.

- Not block out or disadvantage other viable stablecoins. We feel that commodity-backed stablecoins, such as gold-backed, could come to popular fruition in the near future. Any final regulation should keep itself open to such coins.

- Incentivize further private innovations. Tether could not have experienced such incredible growth unless they struck the right cord with instant, global, feeless transactions.

- Demonstrate or outline how retail banks can provide stablecoin-fiat exchanges. This not only provides regulators with valuable data, but ensures a controlled market while maintaining the advantages of stablecoin.

- Ensure that fiat-backed stablecoins are accounted for as cash in balance sheets, even if technically “intangible assets.”

The Bottom Line

Stablecoin regulation presents itself as an absolute necessity, not because of a recent downturn, but because of a much longer period of incredible growth.

Perhaps, regulators should have acted sooner and remained in tune with the private sector which they so regulate, but at least they did act. Traditionally, regulator involvement meant fines and hard rules.

However, in the case of stablecoins, they bring added legitimacy, permanency, liquidity, and ample consumer protections. Stablecoin regulation cements stablecoin’s future.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Conor Scott, CFA, has been active in the wealth management industry since 2012, continuously researching the latest developments affecting portfolio management and cryptocurrency. Mr. Scott is a Freelance Writer for Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service, or offering. It is not a recommendation to trade.