This is usually the next question asked after: “what is Bitcoin?” or “what is Blockchain?” Ethereum (ETH) represents an ambitious blockchain project moving cryptocurrency into uncharted territory by decentralizing a wide range of products and services.

If we think of Bitcoin as digital gold, storing value, then Ethereum clearly takes a different approach. It creates wrappers in which users place custom assets and add rules governing their operations and transfers.

Investors consider Bitcoin a precise tool for a specific job, while Ethereum is more like a Swiss army knife. It enables users to interact with it in novel ways and create new products. In this article, we will go further into the specifics of Ethereum and how it has become the second-largest crypto according to current market capitalization.

Ethereum Basics

Ethereum performs two tasks. It:

- Tracks changes on its blockchain (confirming transactions like Bitcoin)

- Tracks potential changes called “State” (Bitcoin does not do this)

Ethereum contains multi-step functions called “smart contracts.” For example, “A” must do X first, and then “B” will automatically happen, like any basic logic function. State tracks if “A” has completed the relevant task.

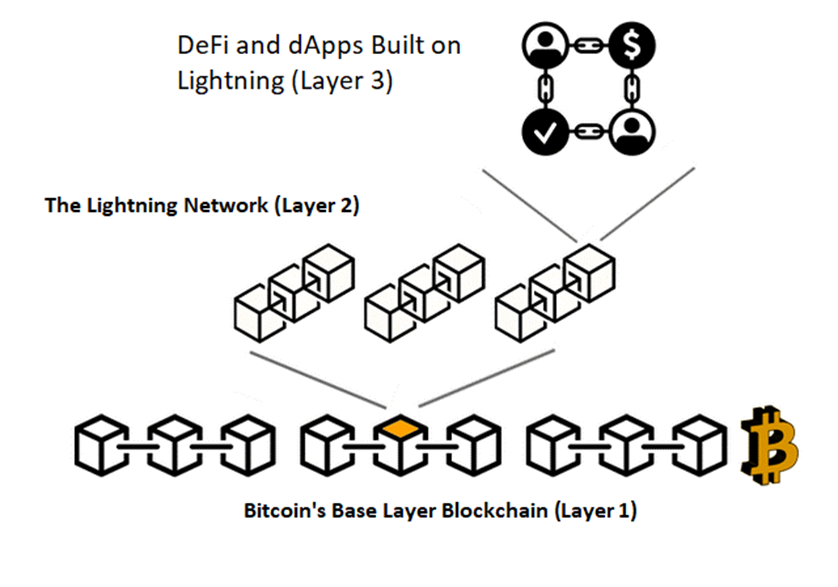

Smart contracts are often linked together and stacked into larger structures which are called decentralized applications or Dapps.

Current Dapps are primitive, but Ethereum proponents believe that Dapps will eventually facilitate the creation of software replicating the services offered by the world’s largest tech companies and financial institutions, such as Amazon.

Let’s think of the Amazon Marketplace as a “state” service connecting buyers with sellers through an easy-to-use graphical interface providing a massive selection of constantly updated inventory. Amazon is just a middleman, a steward of the technology. It takes a (hefty) portion of the sale price for this role. Ethereum is an early attempt of using blockchain to create a marketplace, circumventing these monopolistic services.

To execute these ever-complex Dapps, the Ethereum team created a scripting language native to its own virtual machine, itself funded through the sale of “Ether” coin.

Ethereum’s Origin Story

The idea for Ethereum came from a 20-year-old Russian-Canadian named Vitalik Buterin. Buterin realized that it’s possible to more broadly apply Bitcoin’s design, to, according to Buterin, mitigate the “horrors centralized services can bring.”

Buterin’s famous example refers to the life-changing slight he suffered from a centralized service while playing the online game World of Warcraft. He discovered that the game’s developers could make arbitrary changes at any time, drastically affecting gameplay.

A Theil Fellowship was awarded to Buterin, allowing him to work on Ethereum full time and create a non-profit entity, The Ethereum Foundation. Its sole goal: launch the Ethereum project. In 2014, this project generated $18 million through an online crowd sale of 72 million ETH (roughly worth $255 billion USD in October, 2021).

Ethereum expanded to attract a passionate community of developers and users, who continue to forge its development today. Some of the most notable are:

- Jeff Wilke: creator of Ethereum’s first software implementation

- Gavin Wood: author of Ethereum’s yellow paper defining its virtual machine

- Joseph Lubin: Consensys Founder and Ethereum investment incubator

The Inner Workings of Ethereum

Two Ethereum networks always exist in tandem: the network being used at present and the new network which its developers are building.

Its team maintains an ongoing roadmap since Ethereum’s launch in 2015. Its mandate is to continue growing. This partly explain Ethereum’s many accomplishments since 2015, though several proposed features are still pending.

The Current Ethereum

The Ethereum blockchain from 2015 until today uses a proof-of-work (PoW) consensus mechanism in which “miners” (computers) verify orders and add them to the ongoing blockchain. Through PoW, miners use energy to compete in solving puzzles (find the correct string of numbers called a has) and earn the role of a creator of a new block.

The winning miners receive modest amounts of ETH as their prize. This process repeats every twelve seconds.

Smart contract developers use one of two programming languages: Solidity or Vyper. Being proprietary to Ethereum, they deploy code onto its blockchain. All nodes (the miners running Ethereum software) maintain respective copies of Ethereum’s Virtual Machine (EVM). The EVM is a compiler translating smart contracts written in Solidity or Vyper, and executes them upon the blockchain.

A group of miners who had rejected a proposed Ethereum code update chose to continue running the older code, and this resulted in a new cryptocurrency in 2016 called Ethereum Classic. The two should not be confused.

ETH 2.0, Proof of Stake, and Shards

The original PoW structure of Ethereum is similar to Bitcoin’s blockchain. However, Ethereum is shifting its core operating system with Ethereum 2.0.

The consensus mechanism will change to “Proof-of-Stake” (PoS), swapping traditional miners for “stakers.” Users who have 32 ETH or more can lock their “stakes” and earn rewards for maintaining the blockchain, using less intensive software and hardware than the increasingly power-hungry miners of PoW.

The single (active) Ethereum blockchain will be divided into a group of separate sections called shards, ultimately linked by an overarching “beacon chain” dedicated to improving the entire system’s throughput.

ETH 2.0 upgrades will improve electricity usage and throughput speed, making the chain safer, and should be completed by mid-2022.

Why Does Ethereum Have Value?

The cryptocurrency behind Ethereum is called Ether. New coins of it are minted with every new block miners create. Ether has no supply limit.

Currently, two Ether are created every twelve seconds, though some coins do get burned, thereby limiting the supply.

Developers propose monetary policy changes, which must be agreed upon by nodes. Miners (or after ETH 2.0, stakers) receive fees for their processing work. These are referred to as “gas.” The more complex the smart contact, the more gas used. One of Ethereum’s goals is to constantly increase the utility of Ether and its platform, attracting more stakers despite the implicit ceiling on gas rates.

Why Choose Ethereum?

Ethereum aims to be more than a cryptocurrency, unlike many of the altcoins available, and has created several pillars for increasing demand.

Private Blockchains

Major banks embraced Ethereum by taking advantage of its opensource code, creating proof of concept/R&D initiatives in 2015-16. These projects contained either copies of Ethereum’s code or were Ethereum-inspired, like R3’s Corda and Linux Foundation’s Hyperledger. They used the architecture but did not create a new cryptocurrency.

In 2017, these banking projects led to the Enterprise Ethereum Alliance, a non-profit backing Ethereum and bridging the gap between it and private blockchains.

The ICO Craze

Also in 2017, several entrepreneurial projects used Ethereum as a platform for fundraising. They created new cryptocurrencies and sold them to investors through initial coin offerings (ICOs). Through its ERC20 token standard, Ethereum holds the ability to facilitate new crypto assets without requiring additional, coin-specific blockchains. Chainlink, LiquidiFy, and VeChain are all Ethereum ERC20-based projects.

Decentralized Finance (DeFi)

Ethereum’s most recent innovations are in decentralized finance (DeFi), where Ethereum replicates legacy financial services. For example, MakerDao decentralized USD-pegged cryptocurrency management. Other DeFi projects automate lending and borrowing and represent the most recent use cases for Ethereum’s blockchain.

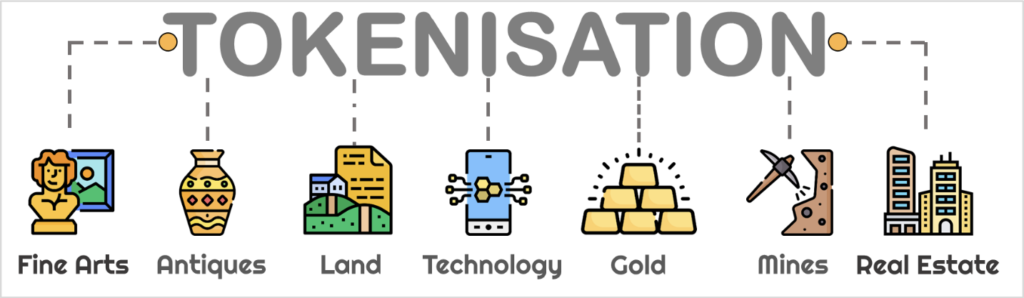

Security Tokens

The most exciting development for Ethereum is in the security token space, where financial assets are converted into digital equivalents. These security tokens are to be traded on decentralized markets, all on the Ethereum network and without expensive middlemen.

The essential requirement of security tokens is legal compliance. Are they complying to all relevant laws and regulations applying to where they are traded? Fortunately, several projects are building compliant tokens.

NFTs

A Bitcoin, a dollar, or an Ether, is “fungible.” One dollar is like any other and has the same value. Art, however, is nonfungible. There may be several copies of the Mona Lisa, but only one is the original.

Nonfungible tokens or NFTs are one-of-a-kind digital assets. These new forms of digital value have become popular over the past year as we see headlines of people buying them for millions of dollars.

Ethereum is well-suited to creating NFTs. The tokens and their respective proofs of ownership can be transferred with ease, while the transfer itself follows pre-defined rules with Ethereum’s smart contracts.

Always Upgrading

Ethereum’s rapid rise in market capitalization proves it to be the ideal choice for blockchain development. It has shifted over the years, though each update adds more functionality to its smart contract abilities. These increases give developers more tools to further expand Ethereum’s capabilities.

Summary

In a handful of years, Ethereum has changed the world of cryptocurrency. It continues to change this world each day. Smart contract functionality, coupled with decentralized management, represents a genius invention carrying ramifications yet to be felt. The future for Ethereum is nothing but bright.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service, or offering. It is not a recommendation to trade.