Deep learning has been applied to computer vision (self-driving cars), natural language processing (speech-to-text), and audio-visual recognition. The successes seen with deep learning as a data processing pathway have attracted interest in several areas, including research and finance.

According to the IDC, banking will be one of the industries that spends the most on AI solutions in the coming years. With the proliferation of Fintech in the recent past, the use of deep learning and AI in finance has already become prevalent.

We want to introduce this field of Deep Learning that is growing in prominence quickly, provide a few examples of how the banking and finance worlds are solving problems with state-of-the-art deep learning models, and give a vision for the future of finance.

Deep Learning Simplified

Deep learning comprises a subset of Artificial Intelligence and Machine Learning that provides the output for a set of highly complex inputs. Within deep learning itself are neural networks and deep neural networks, which we will explain in brief shortly.

Artificial intelligence is our broad idea of learned concepts by machines that are intended to supplement or replace the actions of humans. More simply, AI is a machine that mimics the human mind, with learning, rationalizing, and problem-solving skills.

Machine learning is the application of algorithms and statistical models where a machine will perform a specific task, but does not need any explicit instructions to do so. This ability is because machine learning algorithms are using learned patterns and inferences they gain from past data.

As we move deeper, reaching deep learning, we are now utilizing huge data sets, and the information available is very complex. With this information, a deep learning model can identify errors and correct them without the intervention of humans. Machine learning will not use this sort of in-depth information, and it cannot correct errors without human intervention.

Deep learning takes advantage of neural networks, which are algorithmic systems that can process information the way humans would and then solve various tasks. This is the point where the concept of artificial neural networks comes into play, where the designs mimic a biological neural network (the nerve cells within life forms).

Image courtesy of techvidvan.com

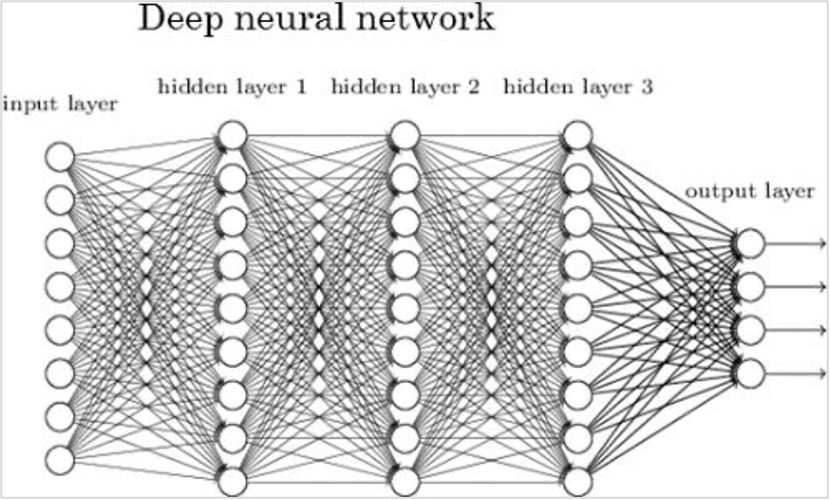

Deep neural networks are created when there is a combined group of artificial neural networks, and this group works together to provide outputs to a set of very complex inputs.

Image courtesy of kdnuggets.com

The more complex the inputs, the better deep neural networks will perform compared to less sophisticated machine learning models.

Deep Learning and Finance

When we turn to finance, artificial intelligence is widely applied to the industry. The banking sector is making investments in fraud analysis and investigation, programmed robo-advisors, and recommendation systems.

Research from Accenture indicates that $1 billion in value will be added to the financial services industry by 2035. AI is being used to identify unusual debit and credit card use or a large number of deposits into an account.

These applications are ways that artificial intelligence can save clients and banks from ongoing fraudulent activity. AI is also being used to make trading easier and more efficient with organized, quick decision-making, taking advantage of the various factors in the markets that neither a single person nor even a team of humans could process at the same rate.

Deep learning provides capabilities to automate complex operations and make decisions at higher degrees of accuracy than other statistical and machine learning methods.

There is an important factor required to run deep learning models, which is the need for a significant volume of high-quality datasets in order to produce these beneficial and more accurate insights. Fortunately, this kind of data is exactly what the financial industry has and can utilize. The plethora of bill payments, transactions, suppliers, customers, prices, and their movements can fuel deep learning models and result in successes.

Supervised Models and Unsupervised Models

Deep learning models are characterized by two broad types:

Supervised and Unsupervised

We won’t go deep into the specific algorithmic models, such as, Convolutional and Recurrent Neural Networks, Self-Organizing Maps (SOMs), and Autoencoders. However, we will say that these supervised and unsupervised models are trained differently and hold different features.

Supervised models are trained with examples of a particular dataset. There is a list of “features” that the data set will include (weather, price, credit score, age, location, employment, salary, etc.), and it also has an output result that can be two or more choices (paid loan off or defaulted, a number or percentage), but the output has been characterized by human intervention.

Unsupervised models are only given input data. They don’t have any set outputs. These models will infer underlying hidden patterns using historical data. With such an approach, a deep learning model will try to find similarities, differences, patterns, and or structure in the data by itself.

For example, the computer knows what a cat picture looks like but does not know that it is specifically a cat nor that there are other cats in the world. It “sees” any image that has two ears, four legs, a tail, fur, and whiskers and predicts that it is a “cat” to the model. This process is considered unsupervised.

If it is told that the first training picture is a cat and a second picture is a cat, but a third is a dog, then it is supervised.

Deep Learning Use Cases

While there are several use cases for deep learning in finance, we will introduce the places where it is already active and provides the most benefit to the financial industry.

Lending

Deep learning systems use learned patterns from historical records and the results of document processing to assess the credit worthiness of loan requests. The input data include income, age, occupation, current financial assets, overdraft history, current credit scores, outstanding balances, foreclosure history, loan payments sizes, and other data points.

Combining all this information, a deep learning model can decide about a client’s qualification for a loan and the likeliness that they will repay the loan as expected. It will further improve based on the results it sees with its own decisions.

Customer Service

Financial service companies are using finance-specific telephone, and web-based chatbots with deep learning models behind them intended to improve the user’s experience. These deep learning-based solutions bring personalized service to customers allowing them to complete several financial activities, including the:

- Automation of frequently completed actions (checking balance, account numbers, recent transactions).

- Suggestion of products that are not currently used by customers but might be a good fit (credit cards and other loan products, overdraft protection).

- Answering of key questions (what balance is needed to waive by account fees?).

Deep learning models can also identify potential churn and prevent customer loss by analyzing interactions and preemptively making special personalized offers to retain the customer. This capability allows insurance companies and banks to provide new plans and discounts that will protect their customer base from other institutions.

Fraud and Compliance

Deep learning is effective at identifying suspicious transactions in real-time with high precision, preventing them before they are complete.

It can also incorporate unstructured data such as satellite and street view images to confirm the existence of a business to facilitate other compliance controls. With these features, deep learning algorithms can reduce a bank’s operational costs while also improving its regulatory compliance.

Improving Credit Utilization

Financial institutions want cardholders to utilize their cards effectively, and deep learning systems can identify optimal consumers. This allows for more meaningful questions to be put on card applications and optimizes the respective credit limits.

Market Predictions and Trading Analyses

Using historical data and additional parameters of the current market, the neural networks of deep learning systems can predict stock values. The systems will utilize detailed data to predict the market and individual asset values.

With more data using its system of hidden layers, a deep learning network’s prediction ability improves. Because a deep learning model can analyze numerous data sources at the same time, including sentiment analysis, it can provide results faster than humans. Lacking emotion, the predictions and trade decisions are neutral and more data-driven.

Robo-Advisory Services

A robo-advisory platform is nothing but algorithms that advise clients or advisors with regard to portfolio allocation and constituents. These tools recommend specific products like insurance, portfolio management, and distribution across various investment opportunities.

Insurance Underwriting

Using historical data, insurance companies train deep learning models to evaluate potential policies. Data can include health records, wearables, potential health issues, income, age, profession, credit history, and more. These models can predict and reduce risks, set more accurate premiums, and improve the speed of the underwriting process.

The Future of Deep Learning in Finance

With the wide offering of services that deep learning provides to finance, the future is bright. According to Varified Market Research, OpenPR.com’s evaluation report on deep learning in finance states that deep learning will continue expanding until at least 2027 and beyond.

The presence of machines making more decisions in the financial realm, which started high-frequency trading, already makes billions of trades possible in a microsecond. By 2018, up to 73% of trading was being done by algorithms, and it is likely higher now.

The global rating agency Crisil told cio.com that they were investing heavily in deep learning and had every intention to continue doing so because of the positive results, stating that they have been adopting automated data extraction tools for unstructured paragraphs, tables, and more. This is a key boon, as Crisil told the magazine that nearly 90% of its key processes are data-driven.

Because automated systems can make operations faster and more accurate, they can maximize returns for financial institutions that apply them. The markets are becoming more sophisticated with added AI trading systems making up more of their trading volume.

Deep learning will imbed its importance in finance and shape the industry to come.

Closing Thoughts

We have provided a brief overview of deep learning and its use in the financial, insurance, and banking worlds. The applications of models are both diverse and new.

What needs to be considered is that the data going into a deep learning model is critical. It needs to be clean and accurate to get the best results. If there is a bias in the data going in, then that same bias will continue, and this has happened in the past.

For example, will we be creating a group that will have access to financial services and completely ignore another set? Will our algorithms for offering credit be extracting too much from our clients, putting them into situations that could be beneficial to us but detrimental to them?

These are all ethical questions that need to be considered when building deep learning models. If created ethically, deep learning models shall become a key pillar of our future.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.