Electric vehicles lead the market in being less expensive to maintain and in operating more efficiently than combustion-engine equivalents. Further, car-sharing produces a lower cost-per-mile-driven for both enterprises and end-users. When you combine this with the progressive automation of vehicles (and the resultant drop in accidents), you have a trifecta of economic drivers encouraging a mobility revolution.

According to Statista, revenues of the ride-hailing and taxi segments are expected to reach $314.2 billion in 2022. These segments succeed where car ownership fails through lower cost and greater ease. Younger generations seem unwilling to burden themselves with the costs of owning vehicles. Environmental factors also play a significant role.

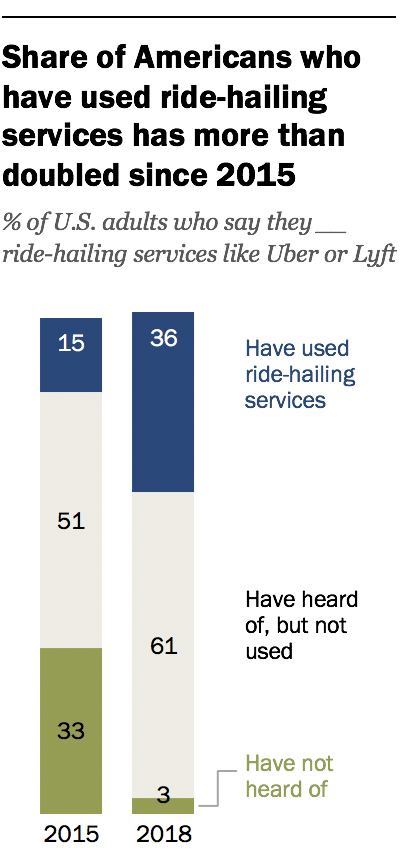

A study by Pew Research shows that the percentage of Americans using ride-sharing services went from 15% to 36% between 2015 and 2018. Despite a slump during the pandemic, continued growth is expected.

Source: https://www.pewresearch.org/fact-tank/2019/01/04/more-americans-are-using-ride-hailing-apps/

Autonomous ridesharing is widely seen as the automotive industry’s next significant step. Large ride-hailing businesses such as Lyft, Uber, and Didi have made significant technological advances in the production of self-driving vehicles. Analysts generally forecast that the likes of Uber and Lyft shall pursue the autonomous market worldwide.

The Cost of Autonomous Ride-Hailing

Analyst for the popular ETF “ARKQ” (Autonomous Technology & Robotics), Tasha Keeney, says that recent research estimates the total addressable opportunity for the ride-hail market to be $11-12 trillion by 2030.

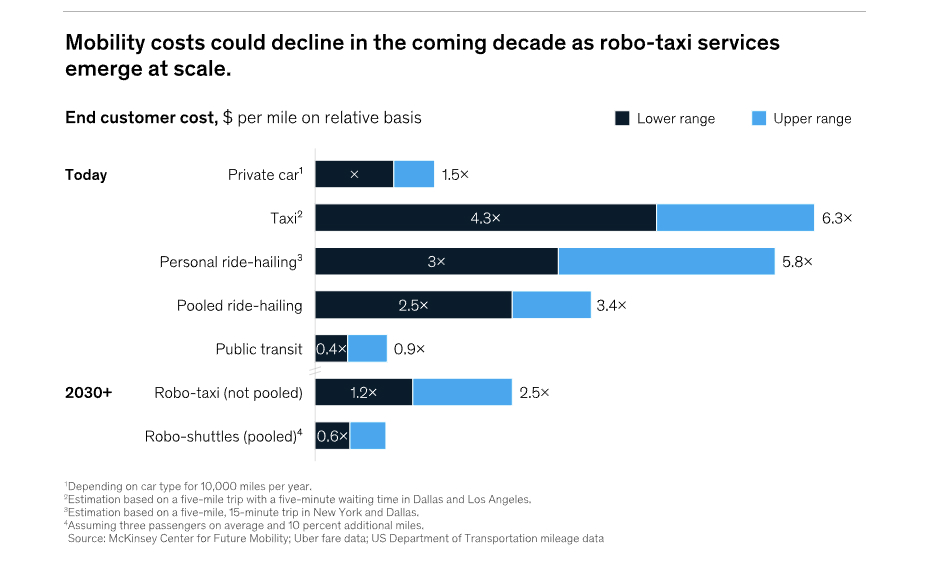

Much of this growth comes from autonomous vehicles over human-driven counterparts, and from lower labour and insurance costs. The current average price of an Uber is $2 per mile, and $0.50-0.70 for Didi. When at scale, platforms could profit from rides costing only $0.25 per mile.

Regulations, technical maturity, business-case attractiveness, and consumer choice all play roles in the deployment of robo-taxis and robo-shuttles.

The cost of an autonomous vehicle heavily influences the consumer’s preference. The high price tag comes from the relativeness newness of the underlying technology, the length of time it takes to develop it, and the operations behind it. This is not so dissimilar to the modern car before the arrival of Ford’s Model T.

We naturally expect the cost of autonomous vehicle production to rapidly decline over this decade. In time, nonautonomous automobiles shall strongly compete against autonomous counterparts.

The Current State of Autonomous Ride-Hailing

The United Nations Economic Commission for Europe (UNECE) approved the deployment of automatic lanes for public highways in January 2021.

Drivers will be able to disengage from the task of driving given certain conditions, such as staying to a speed of less than 60kph (37mph), operating on pedestrian-free roads (i.e., highways), and having an automated 10-second warning (to impact) to re-engage.

Japan and Germany formally allowed “conditional eyes off” or “level 3” autonomous driving on public highways. Meanwhile, the United Kingdom and other European Union countries are anticipated to follow their lead in 2022.

In March 2021, Japan’s Honda announced that the car model “Legend” would be the country’s first level 3 car on the road.

Later in the same year, Germany authorized level 3 vehicles, with Mercedes claiming to be the first original equipment manufacturer to meet worldwide criteria for such cars. France indicated that revisions shall take place so their national legislation includes UNECE’s requirements. The UK stated that level 3 use will be permitted on the road by the end of 2021.

Germany’s Federal Minister, Andreas Scheuer, introduced new rules in February 2021 intended to make it the first country in the world to regulate level 4 autonomous driving. Level 4 autonomy entails the capacity to manoeuvre, steer, accelerate, and brake without a driver’s assistance. USA’s Waymo, and China’s Baidu, already supply and test such mobility services.

How Is the USA Doing?

Tesla has been working on full self-driving (FSD) vehicles in the United States. The firm sent its FSD beta software to approximately a thousand drivers in San Francisco and has actively made various enhancements.

Robo-taxis are the most in-demand self-driving cars, amassing test kilometres and drawing significant investments. Numerous fresh trials were conducted in the United States, China, Dubai, and Europe in the last twelve months. Particularly in China, there is an incredible amount of interest in robo-taxi companies.

Across all nations, private companies vie to hit the streets before others, understanding the potential market opportunity. For example, Cruise, Zoox, and Waymo have concentrated their testing on San Francisco’s crowded streets.

Mobileye plans to launch a driverless commercial on-demand service in Tel Aviv.

Then there’s China, which in November 2021 allowed the commercial use of the country’s first autonomous taxis, developed by Chinese tech giant Baidu and start-up Pony.ai. This brought hundreds of robo-taxis to the streets of Beijing. Also, firms like AutoX and Didi are boosting their testing around the country.

The Aptiv-Hyundai joint venture, Motional, launched a new robo-taxi service in Las Vegas in February 2022. The service provides free rides in autonomous vehicles to the public around downtown Las Vegas, with human safety operators behind the wheel. They want to accomplish two objectives: advertise the service and collect user feedback.

Cruise and Waymo started with free services in San Francisco but were recently given the green light to start charging fees.

The Future

Ride-hailing, autonomous vehicles and electrification continues to converge and offer city dwellers a better way to travel. Research from The Boston Consulting Group (BCG) estimates that by 2030, a quarter of all miles driven in the US will be in shared autonomous vehicles.

Adoption could be even faster and more widespread if technological advances and pricing strategies decrease consumer prices further. Radically different vehicle designs (such as autonomous pods), new customized services (such as pooled ride-sharing), and new income streams (in-vehicle advertising) are all possible innovations waiting to happen.

For many people, their next car purchase seems their last, as the automotive industry transforms. Vehicle manufacturers need to completely redesign their business models and develop new methods of earning revenue.

Level 5 autonomous cars pilot themselves in any environment without human input nor oversight. We are still some ways off in necessary technology and overall consumer trust, but a lot of ground has been covered in the last few years.

While 100% autonomous self-driving is a long-term goal, semi-autonomous vehicles represent a feasible, short-term milestone that provides many of the same advantages. This will effectively slingshot long-term reform and adoption.

Companies owning the autonomous technology stack stand ready to dominate enterprise values within the future automotive ecosystem. So, most of today’s companies may not survive the transformation.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.