The ultimate challenge concerning technology adoption is deciding where to begin. For many businesses, it’s critical to start with savings.

So in the case of insurance companies, savings equates to fraud prevention. Why? The insurance business deals with false claims and similar charades totaling billions of dollars yearly. The Coalition Against Insurance Fraud estimates that insurance fraud costs the United States $80 billion a year.

Notwithstanding, insurance providers remain slow to adapt to emerging technologies such as smart contracts and blockchain. These two technologies carry the potential to eliminate insurance fraud by creating a transparent method of tracking transactions throughout the insurance value chain.

Why Blockchain?

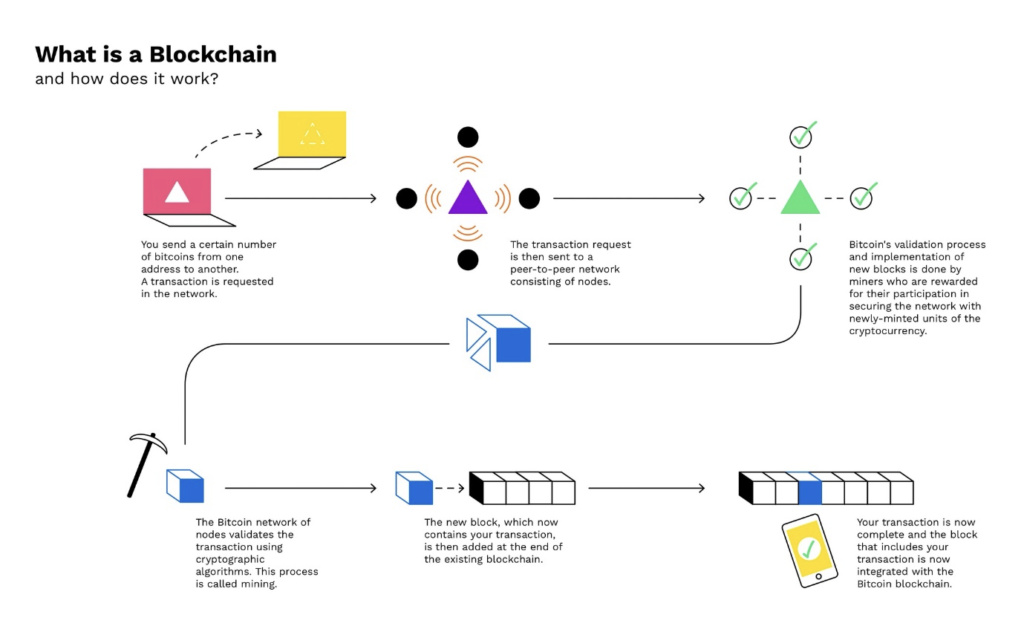

It’s more important to understand how blockchain works, as opposed to the technology behind it. Blockchain is similar to Google Docs. It’s a ledger enabling multiple people to view and edit simultaneously. Satoshi Nakamoto founded it in 2008 to manage bitcoin transactions in a transparent and incorruptible manner. Over time, enthusiasts and followers applied the bitcoin platform to other applications in the financial services and insurance industries.

According to key blockchain industry statistics, it’s rapidly being integrated into the global financial sector, particularly banking. Banks in Japan, the United States, Belarus, Switzerland, and a few other countries are already accepting cryptocurrency transactions as part of their ecosystems, and more will follow suit soon.

In the insurance industry, three general applications are expected to take root:

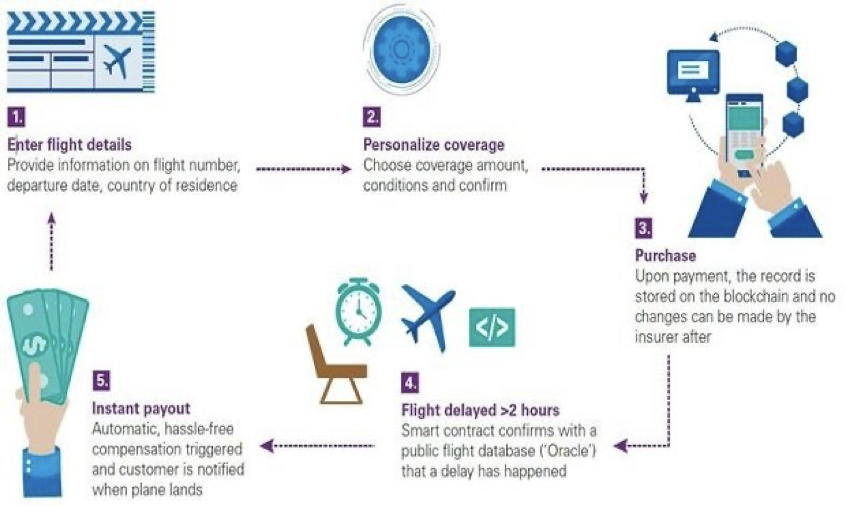

- Smart contracts for insurance policy execution will increase underwriting and claims processing efficiencies. Smart contracts are self-executing contracts in which the terms of the agreement are directly written into lines of code. The code and agreements contained within will eventually exist across a distributed, decentralized blockchain network.

- Firms using a ledger-based mechanism will better manage risk and eliminate sources of fraud in insurance claims.

- The automated flow of information will reduce laggards in the processes between insurers and reinsurers.

In its recent publication: Global Smart Contracts Market, Market Research Future projects that the global smart contracts market will reach approximately $300 million by the end of 2023, or by a 32% CAGR from 2017 to 2023.

Smart Contracts for Insurance

Smart contracts on the blockchain solve many of the insurance industry’s current problems. Overburdened with numerous uncertainties and longstanding issues, it desperately needs to regain the public’s trust.

According to YouGov polls, people in the United States hold mixed feelings about insurance companies. 47% of Americans believe in or trust them, while 43% do not.

Source: https://www.propertycasualty360.com/2020/01/24/how-blockchain-and-smart-contracts-will-disrupt-insurance/

Even though customers believe that an insurer’s ultimate goal is to pay as little as possible, insurance companies are not without their own aches and pains. Very often, policyholders cheat and file false claims to receive payouts. As a result, the lack of trust is mutual.

Smart contracts carry the potential to restore confidence and render intermediaries obsolete. Smart insurance code contains software algorithms able to remove administrative barriers, predetermine all insurance payout scenarios, and automatically execute contract terms, leaving no room for manipulation on either side.

The Benefits of Smart Contracts

There are several benefits to deploying smart contracts with insurance.

Transparency Reduces Fraud

The decentralized and open nature of blockchains provides immediate transparency. Everybody sees the transactions logged into blockchain databases because they have no owners. If changes are made, all parties are notified—meaning, no inconsistencies can be hidden.

Automating Tasks

All smart contract-related processes remain automatic and secure within the blockchain. The main advantage of smart contract insurance: It eliminates mediators and human intervention. This reduces the possibility of manipulation by third-party participants. Furthermore, when used for smart contract insurance, blockchain enables businesses to review their procedures and processes easily.

Claim Verification

In insurance, blockchain smart contracts completely replace claims processes. There are no additional documents required: only predefined rules are required to settle claims. Ultimately, we have faster processes and lower costs for insurers.

Policy Documents

Insurance companies store policy documents on multiple ledgers, making them virtually impossible to lose. Smart contracts similarly prevent data loss and damage due to their technical characteristics.

Assessing Risk

Using blockchains, insurance companies may now include cutting-edge risk assessment models into their smart contracts.

IDs are quickly confirmed and reinforced with fresh data, obviating the need for time-consuming ID verification processes. A smart contract scans all of an individual’s information and automatically assesses risk, saving time and effort over any pre-existing, manual process.

Stages of a Smart Contract’s Lifecycle

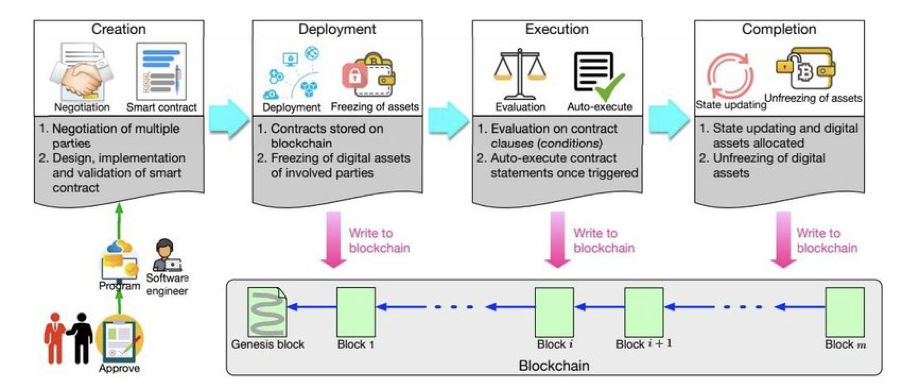

There are four stages to a smart contract’s lifecycle, as illustrated by the graphic below.

Source: https://www.researchgate.net/figure/Smart-Contracts-LifeCycle-1-Creation-of-smart-contracts-Several-involved-parties-first_fig1_340376424

Creation

The parties have reached an agreement on the terms and objectives of the contract. Following that, the agreement is transformed into code through the development processes indicated above.

Deployment

When a smart contract is added to the blockchain, it becomes public and can be accessed via the public ledger. At this point, both contractors must meet all the contract’s requirements, and pay a fee or send an asset in order for this “block” to be added. Further, transfers made to the smart contract’s wallet address are halted until all preconditions are met.

Execution

After a smart contract is executed, new transactions follow, which in turn are put on the same public ledger. The consensus mechanism inherent to blockchain verifies the legitimacy of these transactions.

Finalization

After all, assets are unfrozen and all transactions confirmed, a smart contract is deemed complete.

Barriers Facing Smart Insurance Contracts

Despite tremendous excitement, the public still widely misunderstands the concept that is blockchain. The same holds true for deciphering how to make smart contracts the watertight universal solution for companies. Here are some of the concerns preventing smart contracts from becoming more widely used.

- The scope of the contract is limited. Things that are simple to do on paper can be challenging to translate into code. Especially, since most businesses begin developing smart contracts with basic models, based on the classical formula, if X occurs, then Y follows.

- The technology is complex. Building a sophisticated smart contract in insurance necessitates a certain level of programming expertise. To begin with, only Ethereum experts can create a well-functioning contract. Naturally, it’s a difficult task because the technology is complex, new, and requires a thorough understanding of software development.

- Poor coding leads to contractual errors. Smart contracts are difficult to understand. Because they are carried out sequentially, the contract will not be carried out even if one critical component is missing. Despite the fact that eliminating human input is one of the primary benefits of smart contracts in insurance, smart contracts still require human involvement during the development stage.

- Legal regulations remain limited. Despite the keen interest of public institutions, smart contracts appear largely unregulated.

Summary

Even though smart contracts are not yet mature, they have already had an impact on custom insurance applications. Using smart contracts, insurers cut administrative and claims costs, boost transparency, and avoid fraud by automating their policies and services.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.