Ethereum has maintained a strong position as the second-largest cryptocurrency by market capitalisation after Bitcoin. However, it has gained widespread recognition for its unique technology, smart contracts, and the decentralized applications (dApps).

Ethereum goes far beyond the general abilities of first-generation cryptocurrencies. Since its launch in 2015, Ethereum has grown to become much more than just a digital currency. It has positioned itself as a base layer of computing, serving as the foundation for a variety of applications that rely on its unique abilities combined with its robust and secure infrastructure.

Ethereum’s Benefit, Smart Contracts, and the EVM

At its core, Ethereum, like its big brother Bitcoin, is a decentralised, open-source blockchain platform. However, Ethereum also enables developers to build decentralised applications.

dApps are possible with Ethereum, because it offers a programmable platform that allows developers to create smart contracts, which are self-executing contracts with the terms of the agreement between two or more parties (usually a buyer and seller) being directly written into lines of code. These smart contracts are executed on the Ethereum Virtual Machine (EVM), a decentralised runtime environment that can execute code on the blockchain.

Smart Contract Basics

Ethereum’s smart contracts are built on its blockchain technology, which is a decentralised, secure, and transparent ledger that records all transactions and interactions on the network. Smart contracts are designed to enable, verify, and enforce the negotiation or performance of a contract without the need for intermediaries such as banks, lawyers, or notaries, nor their escrow accounts. While there are similar blockchains, Ethereum is the most popular blockchain for smart contracts.

A smart contract’s encoded terms, stored on a blockchain, are then executed by the blockchain when certain conditions, known as ‘triggering events’, are met. Most of this code is a combination of simple ‘if-then’ statements. For example, in a simple, smart contract for a vending machine, the triggering event is the insertion of the coin: ‘if a coin is inserted’, ‘then’ the trigger releases the treat.

One benefit of blockchain-based smart contracts is that they are immutable, meaning the contract cannot be changed once deployed on the blockchain. Immutability ensures that the terms of the agreement are always executed as written, without the risk of tampering or fraud. It also means that a smart contract must be carefully crafted before it is deployed.

The Ethereum Virtual Machine

The Ethereum Virtual Machine (EVM) is a key component of the Ethereum blockchain. It is a virtual machine responsible for executing Ethereum’s smart contracts and recording transactions on the blockchain.

The EVM is a software environment that allows developers to write smart contracts in high-level programming languages, the most common is Solidity (Ethereum’s native smart contract programming language), and then compile them into bytecode that can be executed on the Ethereum network. The EVM is designed to be platform-independent, meaning that smart contracts can be executed on any device that is running an Ethereum node.

The EVM’s primary benefit is that it allows for the creation of dApps that can run on the Ethereum blockchain. These dApps can provide a wide range of services, such as digital identity, voting systems, supply chain management, and decentralised finance, discussed further below.

Because the EVM is a decentralised platform, these services can be provided without the need for intermediaries or centralised authorities, helping reduce costs and increase the transparency of these functions.

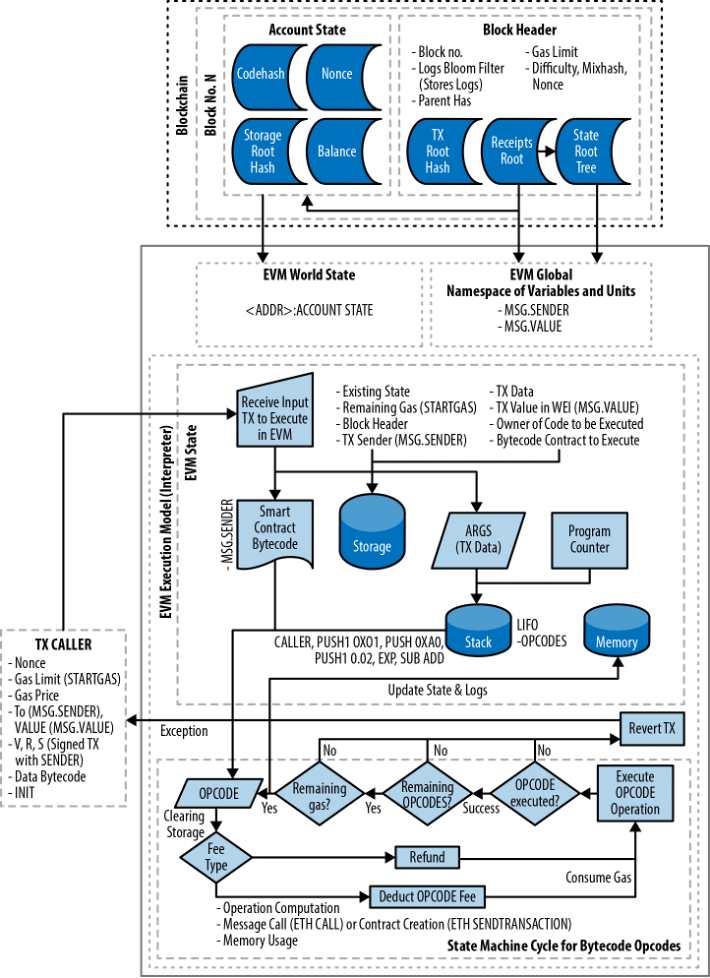

The Ethereum Virtual Machine Architecture and Execution Context Courtesy of github

Another benefit of the EVM is that it provides a high level of security for smart contracts. Smart contracts are executed on the EVM in a sandboxed environment, which means that they are isolated from the rest of the network and cannot access any external resources without explicit permission. This can help to prevent hacks and other security breaches that can occur in traditional software environments.

Ethereum’s Power

While built from simple triggering events, smart contracts can be used for a wide range of applications. This versatility has made Ethereum a popular choice among developers looking to build decentralised applications. Let’s look at a few of the ways these dApps are being utilised.

Digital Identity and Voting Systems

Ethereum is being used for digital identity and voting systems by providing a secure and transparent way to verify and authenticate users. In a digital identity system, an Ethereum smart contract can be used to store and manage user identities, including their personal information and verification documents.

This system can help to prevent identity theft and fraud by ensuring that only authorised users can access the system. In a voting system, smart contracts can be used first to confirm a voter’s identity and then to ensure that votes are recorded and counted accurately while maintaining the anonymity of the voters.

This two-tiered system can help increase the voting process’s transparency and integrity while reducing the risk of tampering or fraud. Overall, using smart contracts for digital identity and voting systems can increase security, transparency, and trust in these critical areas.

Supply Chain Management

Ethereum’s blockchain technology has also found its way into the world of supply chain management. By using smart contracts, businesses can create a decentralised, tamper-proof ledger that records every step of the supply chain by enabling the creation of decentralised supply chain solutions that utilise blockchain technology and smart contracts.

These solutions, known as blockchain supply chain solutions, can provide a high level of transparency and security in the supply chain, by allowing all parties involved (businesses and consumers) to track and verify the movement of goods and information in real-time from the origin to the final destination.

Smart contracts can be used to automate many of the processes in the supply chain, such as payment processing, quality control, and inventory management, which can reduce the risk of errors and fraud. Additionally, blockchain technology can help reduce the risk of counterfeiting and ensure the authenticity of products, which is particularly important in industries such as pharmaceuticals and luxury goods.

Overall, Ethereum’s impact on supply chain management has the potential to increase efficiency, reduce costs, and improve the overall transparency and security of the supply chain.

Gaming

Another area where Ethereum is making significant inroads is in the field of gaming.

Using smart contracts, game developers can create provably fair decentralised games that use blockchain technology, offering transparent and auditable gameplay. These blockchain games, are built on the Ethereum blockchain and allow players to own, trade, and sell in-game items and currency as digital assets.

This system creates a new level of ownership and control for players, allowing for intermediary-less decentralised transactions, and creating a new form of digital economy. Blockchain games also have the potential to reduce the risk of fraud and hacking, as all transactions are recorded on the blockchain and cannot be altered.

Additionally, blockchain games can provide players with a new level of transparency and fairness, as using smart contracts can ensure that the game rules and rewards are enforced without central authorities.

Overall, Ethereum’s impact on gaming has opened up new possibilities for player ownership, security, and fairness, and has the potential to revolutionise the gaming industry as we know it.

Decentralised Finance

Ethereum’s impact on Decentralised Finance (DeFi) has been immense, as it has become the primary blockchain used for DeFi applications. DeFi refers to a new generation of financial services that operate on a decentralised, blockchain-based platform.

These services include lending, borrowing, trading, and investing and are built using smart contracts that automate many of the processes involved in traditional finance. By eliminating intermediaries and providing a more transparent and secure platform, DeFi has the potential to democratise access to financial services and provide more opportunities for people to participate in the global financial system without relying on traditional financial institutions.

Ethereum’s programmable blockchain has enabled the creation of a wide range of DeFi applications, such as decentralised exchanges (DEXs), stablecoins, lending platforms, prediction markets, and yield farming platforms. The use of Ethereum’s native token, Ether (ETH), has also become a key component of the DeFi ecosystem, as it is used as collateral for loans and as a means of exchange on many DeFi platforms.

Overall, Ethereum’s impact on DeFi has opened up new opportunities for financial innovation and has the potential to disrupt traditional finance in a significant way.

DAOs

In recent years, Ethereum has also been used to create decentralised autonomous organisations (DAOs), which are organisations that are run by code rather than a central authority.

DAOs are governed by a set of rules encoded in smart contracts, and decisions are made through a decentralised voting system. This creates a new form of organisational structure that is transparent, efficient, and free from centralised control.

The options that DAOs bring are far-reaching and make the democratisation of many organisations and groups that were once impossible, possible.

Closing Thoughts

Ethereum has become a base layer of computing, serving as the foundation for a variety of applications that rely on its robust and secure infrastructure.

Its ability to support a vast array of use cases, from DeFi and gaming to supply chain management and DAOs, has made it a popular choice among developers looking to build decentralised applications. As blockchain technology continues to mature and become more widely adopted, Ethereum is well-positioned to play a leading role in the decentralisation of various industries.

With the switch to a Proof of Stake (POS) consensus mechanism, the entire Ethereum blockchain system is becoming faster and more energy efficient, allowing more users to participate in the infrastructure. This combination makes Ethereum more competitive and enables it to retain its status as a computing base layer.

Disclaimer: The information provided in this article is solely the author’s opinion and not investment advice – it is provided for educational purposes only. By using this, you agree that the information does not constitute any investment or financial instructions. Do conduct your own research and reach out to financial advisors before making any investment decisions.

The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltec.io.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltec.io.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.