When Bitcoin (BTC) was created, the anonymous inventor Satoshi Nakamoto had a vision of displacing the current monetary structure. That vision now leads us to “Taro.”

Bitcoin was a novel idea. The blockchain provides a way to transfer value securely and transparently between users using a distributed public ledger. Value remains in the form of BTC. Early investors who saw the potential have done incredibly well.

However, Bitcoin lacked the ability to transfer anything besides itself (digital currency). Since Bitcoin’s introduction, other projects, most notably Ethereum, have built additional functionality into their network’s “Layer One,” or its base network. In other words, a crypto’s underlying and primary infrastructure.

This functionality includes smart contracts, which allow for the transfer of more than just the native token of the network. Further, Bitcoin suffers from a bottleneck limiting the number of possible transactions per second.

To address Bitcoin’s transactions per second deficiency, the Layer Two Lightning Network was created. Lightning works together with Bitcoin’s Layer One by removing transactions from the bottleneck’s queue. It bundles a set of transactions into a single transaction, and then sends this bundle onto Bitcoin’s network.

Security and transparency remain while transaction throughput increases alongside a decreasing cost per transaction.

In addition, Bitcoin recently upgraded its Layer One through Taproot. This upgrade adds further security and speed through an enhanced coding language used in writing Bitcoin’s transaction parameters. Combining Lightning with Taproot yields a new protocol available to Bitcoin called Taro.

The Introduction of Taro

In April 2022, a new Bitcoin network protocol was announced by Lightning Labs that intends to compete with the multi-asset capabilities of Ethereum and similar blockchains. This Taproot-powered protocol can issue assets on Bitcoin’s blockchain, which then benefit from Lightning’s bundling service.

This protocol represents a significant shift for the Bitcoin network. Taro allows the network to not just transfer BTC but makes it capable of processing multiple asset types through Lightning. Any currency applies here.

Taro accomplishes this by utilizing the stability and security of the Bitcoin network and its Taproot upgrade, while incorporating the speed, efficiency, and scale possible with the Lightning Network.

How Lightning Will Expand

Taro allows Bitcoin to become a value protocol, enabling app developers to integrate their assets beside BTC in Dapps that remain on-chain and facilitated with the Lightning Network.

Taro expands the Lightning Network’s reach, enabling more users to utilize the network while driving more volume and liquidity for Bitcoin. Taro allows people to easily transfer fiat currencies for bitcoin using apps. Enhanced volume provides the necessary economies of scale while giving node operators more in routing fees.

Dollar “Bitcoinization”

Lightning Labs considers Taro a step towards what it refers to as the “Bitcoinization” of the dollar. It allows for the issuing of stablecoins using the secure and decentralized blockchain Bitcoin. And it allows users to avail themselves of Lightning’s fast and low-fee global payments network.

Taro’s Specifics

Taproot remains the heart of Taro. This upgrade creates a new tree-style structure enabling developers to embed into transactions arbitrary asset metadata. Taproot and Taro use what are called Schnorr signatures to improve Bitcoin’s scalability. Schnorr signatures work with multi-hop transactions on the Lightning network.

With their launch of Taro, Lightning Labs also released a set of Bitcoin Improvement Proposals (BIPs) that they hope to later adopt, and which would further enhance the capability of the network.

Still, Lightning Needs More

2021 was a big year for the Lightning Network. It saw significant growth. Users from Latin America and West Africa came on board quickly and en masse.

Developing nations benefit significantly from the Lightning Network’s peer-to-peer transactions featuring low fees and instantaneous settlements by removing financial intermediaries.

There are several emerging market startups and users who want to add stablecoin assets to the Lightning Network. For example, we have “Bitcoin Beach” from El Salvador. This desire is the reason for Taro.

Taro enables wallet developers to give access to users with a USD-dominated balance, a BTC-dominated balance, or any other asset in the same wallet. They can send any currency across the Lightning Network.

The more users that are brought onto the network and transfer fiat currency, the easier it will be for them to also obtain Bitcoin. This is how Lightning Labs believes Taro can bring Bitcoin to billions of users.

How Does a Taro Over-Lightning Transfer Work?

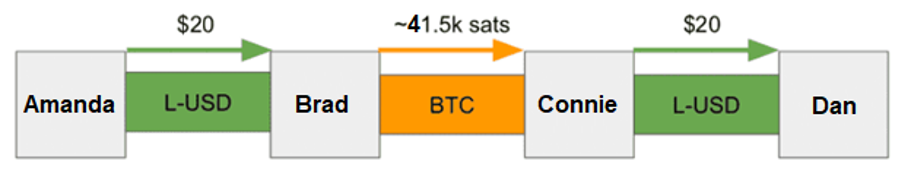

Let’s assume Amanda and Brad have a Lightning-USD channel with $100 of capacity (both have a balanced $50 worth of inbound liquidity). Connie and Dan have a similar L-USD channel with $50 each in inbound liquidity available.

If Brad only has a channel with Connie, Amanda can still send $20 of Lightning-USD to Brad, who will charge a small routing fee in BTC, and then sends the $20 worth of BTC to Connie, who then forwards the L-USD to Dan and also charges a small routing fee.

Taro can interoperate with the BTC-only Lightning Network without changing anything. It only requires the first and last hops to have sufficient Lightning-USD liquidity.

This functionality avoids creating a bootstrapped, new network to transfer new assets. It ensures that Bitcoin remains the foundational medium for all currency transactions conducted on the network. This structure also incentivizes growth promoting Lightning Network’s BTC liquidity, allowing it to serve multiple asset transactions.

What is the Origin of Taro?

Taro relies on the new scripting behavior of Taproot, which was added to the Bitcoin Network as a soft fork in November 2021. Taproot allows developers to embed additional arbitrary asset metadata.

This means that more data can be sent with a single transaction.

- There is no additional burden on the full nodes

- No burning of Bitcoin is needed via the OP_Return opcode

- Taro assets inherit all of the same double-spend protections of normal Bitcoin transfers

- Additional functionality of transferability over the Lightning Network is also given

The Lightning Network was created as a payment channel network and therefore has faster settlements and lower transaction fees than other blockchains. It retains these properties even as the network grows. When Stablecoins are brought to the Bitcoin network via Lightning, we receive:

- Users who want to access financial services

- App developers who desire new tools in their arsenal

- Node operators who can earn more in fees

- Issuers who want to provide a better experience to their users

The Major Benefits of Taro’s Taproot-Native Design

The full list of benefits can be found in the Taro protocol BIPs. The major benefits of this modern Taproot-native design are as follows:

Scalability

An essentially unlimited amount of Taro assets can now be contained within a single Taproot output.

Programmability

Developers are able to program transfer conditions into Taro assets with an unlocking script. This script is like normal unspent transaction outputs (UTXO) of Bitcoin.

Usability

Wallets are smart enough to prevent their users from sending the wrong asset by mistake through asset-specific addresses.

Auditability

Taro’s tree structure allows for efficient supply audits to be conducted within a wallet (locally) as well as within the chain of an issued asset (globally).

Taro’s Pathway Forward

While the announcement of Taro is exciting, much needs to be done. The initial step of launching Taro came with it a series of BIPs, as discussed above.

The next goal is to receive feedback from Bitcoin’s community and the users of its Lightning Network. From there, Lightning Labs must build the necessary tooling that will enable developers to issue and transfer desired assets on the chain. The final required step is to build functionality into Lightning that will enable developers to open Taro asset channels, which can then be used with the Lightning Network.

Presently, Lightning Labs is working on all these goals in tandem.

Taro Is Exciting

The companies building tools on the Lightning Network will be able to integrate the Taro protocol using app integration or through similar methods. Taro can also issue assets on Lightning, which lets users globally harness the decentralization and security Bitcoin provides while working with other currencies or coins.

The protocol is focused on enabling fiat-stablecoin transfers using the Lightning Network, but Taro, as is proposed, is a more general asset issuance and transfer protocol.

Summary

The Taro Proposal is revolutionary for Bitcoin. It adds the functionality that other chains have but to a network with the widest use.

Further, the Lightning Network and Taro interact seamlessly. This is because Taro has accounted for possible pushback from the major parties involved. If the Lightning Network can fulfill its goals for the Taro protocol, we will very likely see new assets transferred on the Bitcoin Network soon.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service, or offering. It is not a recommendation to trade.