The adoption of blockchain technologies and distributed ledgers is still in its infancy for capital markets, and it’s continuing to find new use cases. One of these broad cases is the tokenization of assets whereby the token is a digital representation of either an asset that only exists on a blockchain, a noncertified security, or an asset that exists off the blockchain.

The tokenization of assets from the “real world” continues to grow in popularity, and investments in this space are cropping up across finance.

Tokenization, Short and Sweet

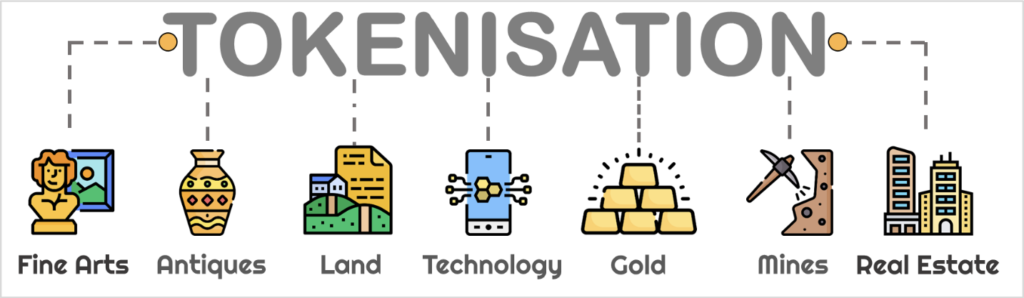

Tokenization is not a new concept for the blockchain space, but the finance industry’s attention is on the tokenization of real-world assets. At its core, tokenization is the conversion of a full right, or at least a portion of ownership, to a digital form (a token) that is stored on a blockchain. Regulated financial instruments, like equities and bonds, futures contracts, precious metals, real estate, and even intellectual property rights for patents, writing, and music could be tokenized.

Graphic courtesy of smart chainers

The benefits of tokenization are apparent for assets that do not currently trade electronically. Items that need increased transparency and basic liquidity stand to benefit greatly, such as artworks and other collectibles.

Tokenization, Fractional Ownership, and Securitization

Through timestamps and encryption, asset tokenization brings improved information security. The terms tokenization, fractional ownership, and securitization are interrelated and easy to confuse but have some considerable differences.

Tokenization is the transformation of real-world assets into digital tokens, increasing their liquidity. However, securitization is the conversion of assets with low liquidity into instruments with higher liquidity. “Security tokens” enable liquid trading with financial exchanges, as well as in over-the-counter (OTC) markets. Blockchain tokenization differs from fractional ownership as the latter refers to shared digital ownership of an asset.

Token Types

Tangible tokens represent assets with specific monetary values and ultimately are in the physical form.

Fungible tokens represent those digital assets which are all equal in value—similar to fiat currency. One bitcoin in your wallet is equal to one bitcoin in someone else’s wallet.

Non-fungible tokens represent digital or real-world assets having unique traits and are not interchangeable, like art.

Tokenization’s Benefits

When physical assets are tokenized, market participants gain several new benefits.

Increased Geographic Reach

By their nature, public blockchains have no barriers. In legacy (developed) markets, extensive Know Your Customer (KYC), and Anti-Money Laundering (AML) regulations must be followed. These requirements have slowed the wider adoption of public blockchains.

Nevertheless, there are now public blockchains performing KYC and AML tasks, building overall trust, and increasing the reach of tokenized assets. This important segment of “Permissioned Blockchains” is evolving, allowing the interest of the all-important institutional investor to grow.

A Growing Investor Base

While institutional investors comprise much of finance, retail investors are also important.

For most real-world assets, there is limited fractionalizations. For example, trading fractions of shares has now grown into a massive market with online brokers.

Selling 1/20th of an apartment or 1/100th of a painting is possible with tokenization. This means a much broader investment base can access and participate in restricted investments such as fine art, which have traditionally only been available to the very wealthy.

24/7 Trading

The tokenization of assets also means 24/7 market liquidity.

These assets sit on the blockchain in smart contract form, available for instantaneous trading so long as the smart contract’s parameters are filled—and these parameters can change throughout the token’s lifecycle. This digitization streamlines trading by removing classical intermediaries.

Counterparty risk is also reduced with blockchain transactions, as is the possibility of trade breaks.

Reduced Administrative Costs

Blockchains are immutable, distributed digital ledgers. Asset recordkeeping is always ongoing, and those records are easily accessible.

Administrative tasks like profit sharing, buybacks, voting rights, dividends, and stock splits are much more efficient with tokenization and distributed ledger technology. As the world’s markets slowly accept the distributed ledger as golden, the need for reconciliation could potentially be eliminated, with users just accepting the ledger as is.

Upgraded Infrastructure

Many asset classes are slow and labor-intensive, like real estate or private equity. They require the exchange of traditional paper-based documentation.

With the digitization of such assets on distributed ledgers, the efficiency of these markets can be greatly improved. The possibilities for other segments currently having limited infrastructure become apparent as well.

Improved Regulation

Regulators are slowly moving into preestablished markets and laying the foundation of a regulatory framework for digital asset exchanges. The real-time immutable data contained in a digital ledger enhances the protection of investors.

Asset Collateralization

With the fractionalization of novel asset classes, tokenization expands the range of collateral to beyond traditional assets.

This significantly increases market activity by providing a new universe of acceptable noncash holdings to be staked as collateral. Through blockchain technology, collateral management can be effectual, transparent, and available to new asset classes.

The Future of Tokenization

Large financial institutions already understand the opportunities that the tokenization of financial assets brings.

The transition of legacy assets like corporate securities into digital markets is tempting. We are already seeing American and European exchanges take steps in the development of tokenized offerings. In addition, the enhanced liquidity purports new fiduciary duties for financial services providers.

We are still in the embryonic stage of security tokens, yet these have the potential to change the entire financial services industry–making markets more dynamic, bringing in new investors, and fractionalizing investments. The sky is the limit.

Disclaimer: The author of this text, Jean Chalopin, is a global business leader with a background encompassing banking, biotech, and entertainment. Mr. Chalopin is Chairman of Deltec International Group, www.deltecbank.com.

The co-author of this text, Robin Trehan, has a bachelor’s degree in economics, a master’s in international business and finance, and an MBA in electronic business. Mr. Trehan is a Senior VP at Deltec International Group, www.deltecbank.com.

The views, thoughts, and opinions expressed in this text are solely the views of the authors, and do not necessarily reflect those of Deltec International Group, its subsidiaries, and/or its employees.